Uncover Secrets: Airtel Mobile Money Charges Demystified

Airtel mobile money charges refer to the fees associated with using Airtel's mobile money service. These charges may include a flat fee for sending or receiving money, a percentage of the transaction amount, or a combination of both. The specific charges can vary depending on the country or region in which the service is being used.

Airtel mobile money charges can be an important consideration for users of the service. These charges can impact the overall cost of using the service, and they can also affect the convenience and usability of the service. For example, if the charges are too high, users may be discouraged from using the service, or they may only use it for small transactions. On the other hand, if the charges are reasonable, users may be more likely to use the service for a wider range of transactions.

The importance of Airtel mobile money charges is likely to continue to grow in the years to come. As mobile money services become more widely used, users will become increasingly price-sensitive. As a result, Airtel and other mobile money providers will need to carefully consider their pricing strategies in order to attract and retain customers.

- Unveiling Henry Aronofskys Age A Journey Of Cinematic Evolution

- Bianca Lawson Unraveling The Enigma Of Motherhood

- Unveiling The Musical Dynasty Discoveries From The Ilaiyaraaja Siblings

- Discover The Significance Of Cultural Exchange Pom Klementieffs Family Meets Costars

- I Just Lost My Dawg Lyrics

Airtel Mobile Money Charges

Airtel mobile money charges are the fees associated with using Airtel's mobile money service. These charges can vary depending on the country or region in which the service is being used. It is important to be aware of these charges before using the service, as they can impact the overall cost and convenience of using the service.

- Transaction fees: These are the fees charged for sending or receiving money using Airtel mobile money.

- Withdrawal fees: These are the fees charged for withdrawing money from an Airtel mobile money account.

- Deposit fees: These are the fees charged for depositing money into an Airtel mobile money account.

- Balance inquiry fees: These are the fees charged for checking the balance of an Airtel mobile money account.

- Account maintenance fees: These are the fees charged for maintaining an Airtel mobile money account.

- Currency conversion fees: These are the fees charged for converting one currency to another when using Airtel mobile money.

- International transaction fees: These are the fees charged for sending or receiving money to or from another country using Airtel mobile money.

- Taxes: Taxes may be applicable on Airtel mobile money charges, depending on the country or region in which the service is being used.

- Other fees: There may be other fees associated with using Airtel mobile money, such as fees for using certain value-added services.

It is important to compare the charges of different mobile money providers before choosing a service. This will help you to find the most affordable and convenient service for your needs.

Transaction fees

Transaction fees are an important part of airtel mobile money charges. These fees can impact the overall cost of using the service, and they can also affect the convenience and usability of the service.

- Unveiling The Dynamic Duo Discoveries And Insights About Bryan De La Cruzs Brother

- Taylor Lewan Now Unlocking Secrets Of An Nfl Titan

- Uncover The Secrets Behind El Pack De Yeferson Cossio

- Discover The Enigmatic World Of Jason Butler Harners Wife

- Unveiling The Cinematic Treasures Of Lone Pine A Western Odyssey With James Marsden

- Facet 1: Impact on cost

Transaction fees can have a significant impact on the cost of using Airtel mobile money. For example, if the transaction fee is high, it may discourage users from using the service for small transactions. This could make it more difficult for users to manage their finances effectively.

- Facet 2: Impact on convenience

Transaction fees can also impact the convenience of using Airtel mobile money. For example, if the transaction fee is high, users may be less likely to use the service for everyday transactions. This could make it more difficult for users to access their money when they need it.

- Facet 3: Impact on usability

Transaction fees can also impact the usability of Airtel mobile money. For example, if the transaction fee is high, users may be less likely to use the service for complex transactions. This could make it more difficult for users to manage their finances effectively.

Overall, transaction fees are an important consideration for users of Airtel mobile money. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that you can make informed decisions about how to use it.

Withdrawal fees

Withdrawal fees are an important part of airtel mobile money charges. These fees can impact the overall cost of using the service, and they can also affect the convenience and usability of the service.

- Facet 1: Impact on cost

Withdrawal fees can have a significant impact on the cost of using Airtel mobile money. For example, if the withdrawal fee is high, it may discourage users from withdrawing money from their accounts. This could make it more difficult for users to access their money when they need it.

- Facet 2: Impact on convenience

Withdrawal fees can also impact the convenience of using Airtel mobile money. For example, if the withdrawal fee is high, users may be less likely to use the service for everyday transactions. This could make it more difficult for users to manage their finances effectively.

- Facet 3: Impact on usability

Withdrawal fees can also impact the usability of Airtel mobile money. For example, if the withdrawal fee is high, users may be less likely to use the service for complex transactions. This could make it more difficult for users to manage their finances effectively.

Overall, withdrawal fees are an important consideration for users of Airtel mobile money. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that you can make informed decisions about how to use it.

Deposit fees

Deposit fees are an important part of airtel mobile money charges. These fees can impact the overall cost of using the service, and they can also affect the convenience and usability of the service.

The connection between deposit fees and airtel mobile money charges is that deposit fees are one of the components that make up the total cost of using the service. When a user deposits money into their Airtel mobile money account, they will be charged a deposit fee. The amount of the deposit fee will vary depending on the amount of money being deposited and the country or region in which the service is being used.

Deposit fees can have a significant impact on the cost of using Airtel mobile money. For example, if the deposit fee is high, it may discourage users from depositing money into their accounts. This could make it more difficult for users to access their money when they need it.

In addition to the impact on cost, deposit fees can also impact the convenience and usability of Airtel mobile money. For example, if the deposit fee is high, users may be less likely to use the service for everyday transactions. This could make it more difficult for users to manage their finances effectively.

Overall, deposit fees are an important consideration for users of Airtel mobile money. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that you can make informed decisions about how to use it.

Balance inquiry fees

Balance inquiry fees are a component of airtel mobile money charges. These fees are charged to customers for checking the balance of their Airtel mobile money accounts. The amount of the balance inquiry fee will vary depending on the country or region in which the service is being used.

Balance inquiry fees can have a significant impact on the cost of using Airtel mobile money. For example, if the balance inquiry fee is high, it may discourage customers from checking their account balance frequently. This could lead to customers overdrafting their accounts or incurring other fees.

In addition to the impact on cost, balance inquiry fees can also impact the convenience and usability of Airtel mobile money. For example, if the balance inquiry fee is high, customers may be less likely to use the service for everyday transactions. This could make it more difficult for customers to manage their finances effectively.

Overall, balance inquiry fees are an important consideration for customers of Airtel mobile money. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that customers can make informed decisions about how to use it.

Account maintenance fees

Account maintenance fees are a component of airtel mobile money charges. These fees are charged to customers for maintaining their Airtel mobile money accounts. The amount of the account maintenance fee will vary depending on the country or region in which the service is being used.

Account maintenance fees can have a significant impact on the cost of using Airtel mobile money. For example, if the account maintenance fee is high, it may discourage customers from opening or maintaining an Airtel mobile money account. This could lead to customers missing out on the benefits of using Airtel mobile money, such as the ability to send and receive money, pay bills, and purchase goods and services.

In addition to the impact on cost, account maintenance fees can also impact the convenience and usability of Airtel mobile money. For example, if the account maintenance fee is high, customers may be less likely to use the service for everyday transactions. This could make it more difficult for customers to manage their finances effectively.

Overall, account maintenance fees are an important consideration for customers of Airtel mobile money. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that customers can make informed decisions about how to use it.

Currency conversion fees

Currency conversion fees are an important component of Airtel mobile money charges. These fees are charged to customers when they convert one currency to another using their Airtel mobile money accounts. The amount of the currency conversion fee will vary depending on the amount of money being converted and the currencies being converted.

- Facet 1: Impact on cost

Currency conversion fees can have a significant impact on the cost of using Airtel mobile money. For example, if the currency conversion fee is high, it may discourage customers from converting currencies. This could lead to customers losing money on exchange rate fluctuations or being unable to make payments in foreign currencies.

- Facet 2: Impact on convenience

Currency conversion fees can also impact the convenience of using Airtel mobile money. For example, if the currency conversion fee is high, customers may be less likely to use the service for international transactions. This could make it more difficult for customers to send money to family and friends abroad or to purchase goods and services from foreign websites.

- Facet 3: Impact on usability

Currency conversion fees can also impact the usability of Airtel mobile money. For example, if the currency conversion fee is high, customers may be less likely to use the service for complex transactions. This could make it more difficult for customers to manage their finances effectively.

Overall, currency conversion fees are an important consideration for customers of Airtel mobile money. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that you can make informed decisions about how to use it.

International transaction fees

International transaction fees are an important component of airtel mobile money charges. These fees are charged to customers when they send or receive money to or from another country using their Airtel mobile money accounts. The amount of the international transaction fee will vary depending on the amount of money being sent or received and the countries involved.

International transaction fees can have a significant impact on the cost of using Airtel mobile money for international transactions. For example, if the international transaction fee is high, it may discourage customers from sending or receiving money to or from other countries. This could make it more difficult for customers to send money to family and friends abroad or to purchase goods and services from foreign websites.

In addition to the impact on cost, international transaction fees can also impact the convenience and usability of Airtel mobile money for international transactions. For example, if the international transaction fee is high, customers may be less likely to use the service for international transactions. This could make it more difficult for customers to manage their finances effectively.

Overall, international transaction fees are an important consideration for customers of Airtel mobile money who frequently engage in international transactions. These fees can impact the cost, convenience, and usability of the service. It is important to be aware of these fees before using the service so that customers can make informed decisions about how to use it.

Taxes

Taxes are an important consideration for users of Airtel mobile money. In some countries or regions, taxes may be applicable on Airtel mobile money charges. This can impact the overall cost of using the service, and it can also affect the convenience and usability of the service.

- Facet 1: Impact on cost

Taxes can have a significant impact on the cost of using Airtel mobile money. For example, if the tax rate is high, it may discourage users from using the service for small transactions. This could make it more difficult for users to manage their finances effectively.

- Facet 2: Impact on convenience

Taxes can also impact the convenience of using Airtel mobile money. For example, if the tax rate is high, users may be less likely to use the service for everyday transactions. This could make it more difficult for users to access their money when they need it.

- Facet 3: Impact on usability

Taxes can also impact the usability of Airtel mobile money. For example, if the tax rate is high, users may be less likely to use the service for complex transactions. This could make it more difficult for users to manage their finances effectively.

Overall, taxes are an important consideration for users of Airtel mobile money. Taxes can impact the cost, convenience, and usability of the service. It is important to be aware of these taxes before using the service so that users can make informed decisions about how to use it.

Other fees

In addition to the standard fees associated with Airtel mobile money, there may be other fees charged for using certain value-added services. These fees can vary depending on the specific service being used, and they may be charged on a one-time or recurring basis.

For example, some Airtel mobile money users may be charged a fee for using the service to purchase airtime or data bundles. Other users may be charged a fee for using the service to pay bills or send money to international recipients.

It is important to be aware of these other fees before using Airtel mobile money so that you can budget accordingly. You can find more information about these fees by visiting the Airtel website or by contacting customer service.

The presence of other fees is an important consideration for users of Airtel mobile money. These fees can impact the overall cost of using the service, and they can also affect the convenience and usability of the service. It is important to be aware of these fees before using the service so that you can make informed decisions about how to use it.

FAQs on Airtel Mobile Money Charges

This section provides answers to frequently asked questions about Airtel mobile money charges. Understanding these charges is crucial for effectively utilizing the service.

Question 1: What types of charges are associated with Airtel mobile money?

Answer: Airtel mobile money charges may include transaction fees, withdrawal fees, deposit fees, balance inquiry fees, account maintenance fees, currency conversion fees, international transaction fees, taxes, and fees for using certain value-added services.

Question 2: How do Airtel mobile money charges impact the cost of using the service?

Answer: Charges can affect the overall cost of using Airtel mobile money. Factors such as transaction fees, withdrawal fees, and currency conversion fees can accumulate, influencing the total amount spent.

Question 3: How do Airtel mobile money charges impact the convenience of using the service?

Answer: Charges can impact convenience. For instance, high withdrawal fees may discourage frequent withdrawals, affecting accessibility to funds.

Question 4: How do Airtel mobile money charges impact the usability of the service?

Answer: Charges can influence usability. For example, complex fee structures or hidden charges may make it challenging to manage finances effectively.

Question 5: Are there any additional fees besides the standard Airtel mobile money charges?

Answer: Yes, there may be additional fees for using specific value-added services, such as airtime or data bundle purchases through Airtel mobile money.

Question 6: Where can I find more information about Airtel mobile money charges?

Answer: You can find detailed information about Airtel mobile money charges on the Airtel website or by contacting their customer service.

Summary: Understanding Airtel mobile money charges is essential for managing your finances effectively. Consider the various types of charges, their impact on cost, convenience, and usability, and any additional fees that may apply. By being informed about these charges, you can make informed decisions while using Airtel mobile money.

Next Section: Understanding the Benefits of Using Airtel Mobile Money

Tips for Managing Airtel Mobile Money Charges

Understanding Airtel mobile money charges is crucial for optimizing the service. Here are some tips to help you manage these charges effectively:

Tip 1: Familiarize yourself with the different types of charges:

Be aware of the various charges associated with Airtel mobile money, including transaction fees, withdrawal fees, and currency conversion fees. Understanding these charges will help you plan your transactions accordingly.

Tip 2: Compare charges with other service providers:

Before using Airtel mobile money, compare its charges with those of other service providers. This will help you choose the most cost-effective option that aligns with your usage patterns.

Tip 3: Consider using value-added services wisely:

While value-added services can enhance convenience, be mindful of any associated charges. Only use these services when necessary to avoid unnecessary expenses.

Tip 4: Take advantage of promotions and discounts:

Airtel may offer promotions or discounts on mobile money charges from time to time. Keep an eye out for these opportunities to save money on your transactions.

Tip 5: Monitor your transactions regularly:

Regularly review your Airtel mobile money transaction history to identify any unexpected or excessive charges. This will help you stay in control of your expenses.

Tip 6: Contact customer service for assistance:

If you have any questions or concerns regarding Airtel mobile money charges, don't hesitate to contact their customer service. They can provide you with personalized guidance and support.

Summary:

By following these tips, you can effectively manage Airtel mobile money charges and optimize your usage of the service. Remember to stay informed about the different types of charges, compare with other providers, and take advantage of available promotions. Regular monitoring and prudent use of value-added services will help you control your expenses and maximize the benefits of Airtel mobile money.

Next Section: Conclusion

Conclusion

Airtel mobile money charges are an essential aspect of the service that should be carefully considered before using it. These charges can impact the overall cost, convenience, and usability of the service. By understanding the different types of charges and how they can affect your usage, you can make informed decisions about how to use Airtel mobile money.

It is important to compare the charges of different mobile money providers before choosing a service. This will help you find the most affordable and convenient service for your needs. You should also be aware of any additional fees that may be charged for using certain value-added services.

By following the tips outlined in this article, you can effectively manage Airtel mobile money charges and optimize your usage of the service. Remember to stay informed about the different types of charges, compare with other providers, and take advantage of available promotions. Regular monitoring and prudent use of value-added services will help you control your expenses and maximize the benefits of Airtel mobile money.

- Unveiling Sabrina Carpenters Measurements Insights And Discoveries

- Unveiling Cashleigh Discover The Hidden Potential And Meaning

- How Old Is Rob Lowe

- Unveiling The Intriguing Truths Behind Alex Turners Height

- Unveiling The Dynamic Duo Discoveries And Insights About Bryan De La Cruzs Brother

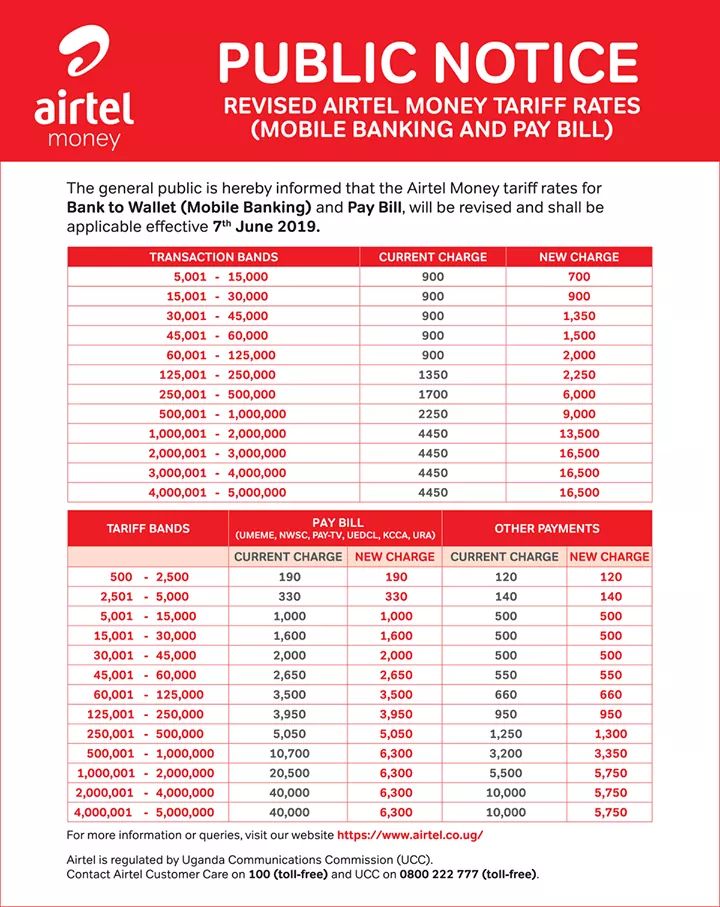

In Uganda, Airtel money charges in 2019, including mobile money to bank

New Airtel Money Withdraw & Sending Charges Tanzania 2022