Uncover The Secrets Of Airtel Money Uganda Withdrawal Charges

Airtel Money Uganda withdrawal charges refer to the fees levied by Airtel Uganda for withdrawing funds from an Airtel Money account.

The charges vary depending on the withdrawal method used, the amount being withdrawn, and the agent or bank involved. Generally, withdrawals made through Airtel agents attract a lower fee compared to withdrawals made through banks. The charges are also higher for larger withdrawal amounts.

It is important for Airtel Money users to be aware of the withdrawal charges before initiating a withdrawal transaction to avoid any unexpected costs. The charges can be found on Airtel Uganda's website or by contacting customer care.

- Dog Looking Up Meme

- How Old Is Rob Lowe

- Uncovering The Depth Of Olivia Jeans Music Insights From Her Journey And Age

- Im Doing It Are You

- Noelle Leyvas Onlyfans Leak Uncovered Secrets And Revelations

Airtel Money Uganda Withdrawal Charges

Airtel Money Uganda withdrawal charges are the fees levied by Airtel Uganda for withdrawing funds from an Airtel Money account. Understanding these charges is crucial for users to avoid unexpected costs and make informed decisions about their transactions.

- Amount: The withdrawal amount significantly impacts the charges, with larger amounts attracting higher fees.

- Method: Withdrawals made through Airtel agents generally have lower charges compared to withdrawals made through banks.

- Location: The location of the withdrawal (agent or bank branch) can also influence the charges.

- Time: Airtel Uganda may charge different fees for withdrawals made at different times of the day or night.

- Frequency: Frequent withdrawals may result in higher cumulative charges.

- Account balance: The available balance in the Airtel Money account can affect the charges.

- Transaction type: Different types of withdrawal transactions, such as cash withdrawals or mobile money transfers, may have varying charges.

- Promotions: Airtel Uganda may offer promotions or discounts that impact withdrawal charges.

These aspects collectively determine the withdrawal charges for Airtel Money Uganda users. By considering these factors, users can optimize their withdrawals and manage their Airtel Money accounts effectively.

Amount

The withdrawal amount is a primary determinant of Airtel Money Uganda withdrawal charges. This is because Airtel Uganda, like many financial institutions, implements a tiered fee structure for withdrawals. The larger the withdrawal amount, the higher the fee charged. This is a common practice in the financial industry to cover the operational costs associated with processing and securing larger transactions.

- Unveiling Joran Van Der Sloots Height Exploring Insights And Surprising Revelations

- Unveiling The Timeless Legacy A Journey Through Ilayarajas Age

- Unlock The Secrets Of Educational Excellence Discoveries From Kenneth Weate

- Unveiling The World Of Brook Ashcraft Secrets Success And Surprises

- Dark Hair With Highlights

For instance, if an Airtel Money Uganda user withdraws 100,000 Ugandan shillings, they may be charged a fee of 500 shillings. However, if they withdraw 500,000 Ugandan shillings, the fee may increase to 1,500 shillings. This fee differential is intended to offset the increased risk and resources required to process larger withdrawals.

Understanding the impact of withdrawal amount on charges is crucial for Airtel Money Uganda users. By being aware of this relationship, users can plan their withdrawals accordingly and minimize unnecessary fees. It also encourages responsible financial management by discouraging excessive or impulsive withdrawals.

Method

This aspect of Airtel Money Uganda withdrawal charges highlights the cost difference between using Airtel agents and banks for withdrawals. Understanding this distinction is vital for users to make informed decisions and optimize their transactions.

- Convenience: Airtel agents are widely distributed and offer convenient access to withdrawal services. This accessibility often translates to lower charges compared to banks, which may have limited branch networks and operating hours.

- Operational costs: Airtel agents typically have lower operational costs than banks. They do not require the same level of infrastructure, staffing, or regulatory compliance as banks. These cost savings are often passed on to customers in the form of lower withdrawal charges.

- Transaction volume: Airtel agents often process a higher volume of withdrawal transactions compared to banks. This scale allows them to negotiate more favorable terms with Airtel Uganda, resulting in lower charges for their customers.

- Competition: The presence of numerous Airtel agents creates a competitive environment that drives down withdrawal charges. Agents compete for customers by offering lower fees and better exchange rates.

By understanding the factors contributing to lower withdrawal charges through Airtel agents, users can make informed decisions about their withdrawal methods. This knowledge empowers them to save money and optimize their Airtel Money Uganda transactions.

Location

The location of the withdrawal plays a role in determining Airtel Money Uganda withdrawal charges. This aspect encompasses two primary factors: agent location and bank branch location.

- Agent Location:

The location of the Airtel agent can impact the withdrawal charges. Agents in remote or less accessible areas may charge higher fees to cover their transportation and operational costs. Additionally, agents in high-traffic areas may offer lower fees due to increased competition.

- Bank Branch Location:

The location of the bank branch can also affect the withdrawal charges. Withdrawals made at branches in urban areas or central business districts may attract higher fees compared to withdrawals made at branches in rural or suburban areas. This is because banks in prime locations often have higher operating costs, including rent, utilities, and staff salaries.

Understanding the influence of location on withdrawal charges empowers Airtel Money Uganda users to make informed decisions. By choosing to withdraw from agents or bank branches in strategic locations, users can potentially save money and optimize their transactions.

Time

The timing of an Airtel Money Uganda withdrawal transaction can have an impact on the charges levied. This aspect introduces the concept of time-based pricing, which is employed by Airtel Uganda to manage its operational costs and customer demand.

- Peak and Off-Peak Hours:

Airtel Uganda may implement a tiered pricing structure based on peak and off-peak hours. During peak hours, when there is a high demand for withdrawal services, the charges may be higher to discourage excessive transactions and maintain system stability. Conversely, during off-peak hours, when there is less demand, the charges may be lower to encourage withdrawals and optimize resource utilization.

- Night-Time Surcharges:

Some Airtel Money Uganda agents may impose night-time surcharges for withdrawals made after a certain hour, typically late at night or early morning. These surcharges are intended to cover the additional costs associated with operating during non-standard business hours, such as security and staffing expenses.

- Emergency Withdrawals:

In certain cases, Airtel Uganda may offer emergency withdrawal services outside of regular business hours or during system outages. These emergency withdrawals may attract higher charges due to the additional resources and support required to facilitate them.

- Public Holidays:

Airtel Money Uganda withdrawal charges may also vary on public holidays. Some agents or banks may charge higher fees to cover the costs of operating on these days, which often require additional staffing and security arrangements.

Understanding the potential variations in Airtel Money Uganda withdrawal charges based on time can help users plan their transactions accordingly. By withdrawing during off-peak hours or avoiding night-time surcharges, users can potentially save money and manage their expenses effectively.

Frequency

The frequency of Airtel Money Uganda withdrawals is an important factor to consider when managing withdrawal charges. Frequent withdrawals, especially of small amounts, can accumulate over time and result in higher cumulative charges compared to less frequent withdrawals of larger amounts.

This is because each withdrawal transaction incurs a fixed or tiered fee, depending on the withdrawal method and amount. By making multiple small withdrawals, users may end up paying a higher total fee than if they had made a single withdrawal of the cumulative amount. Additionally, some Airtel Money agents may impose a minimum withdrawal amount, below which a higher fee may be charged.

Understanding the impact of withdrawal frequency on charges empowers users to optimize their transactions and minimize unnecessary expenses. By planning their withdrawals and consolidating smaller amounts into larger, less frequent withdrawals, users can effectively manage their Airtel Money Uganda withdrawal charges.

Account balance

The available balance in an Airtel Money account plays a role in determining the withdrawal charges. This aspect introduces the concept of balance-based pricing, which is employed by Airtel Uganda to manage its operational costs and customer behavior.

- Minimum balance requirement:

Some Airtel Money agents or banks may impose a minimum balance requirement for withdrawals. If the available balance falls below this minimum, a higher withdrawal fee may be charged to cover additional processing costs and maintain account viability.

- Tiered charges based on balance:

Airtel Uganda may implement a tiered pricing structure for withdrawals based on the available balance. Withdrawals from accounts with higher balances may attract lower charges as a reward for customer loyalty and to encourage larger transactions.

- Overdraft fees:

In cases where the withdrawal amount exceeds the available balance, Airtel Money Uganda may allow overdraft withdrawals. However, these overdraft withdrawals typically incur higher charges to discourage overspending and promote responsible financial management.

- Balance verification:

Airtel Money Uganda may charge a fee for balance verification services. This fee is intended to cover the costs associated with providing real-time balance information to customers.

Understanding the potential impact of account balance on withdrawal charges empowers Airtel Money Uganda users to manage their accounts effectively. By maintaining a sufficient balance, avoiding overdrafts, and utilizing balance verification services wisely, users can optimize their withdrawals and minimize unnecessary charges.

Transaction type

The type of withdrawal transaction initiated through Airtel Money Uganda directly influences the withdrawal charges. Understanding these variations empowers users to make informed decisions and optimize their transactions.

- Cash Withdrawals:

Cash withdrawals, where physical cash is dispensed from an Airtel Money agent or ATM, typically incur higher charges compared to other transaction types. This is because cash withdrawals involve additional costs such as cash handling, security, and transportation.

- Mobile Money Transfers:

Mobile money transfers, where funds are transferred from one Airtel Money account to another, generally attract lower charges than cash withdrawals. This is because mobile money transfers are processed electronically, eliminating the need for physical cash handling and associated costs.

- Bank Transfers:

Bank transfers, where funds are transferred from an Airtel Money account to a bank account, may incur varying charges depending on the bank and the transfer method used. Some banks may charge a fixed fee for Airtel Money transfers, while others may charge a percentage-based fee.

- Utility Bill Payments:

Utility bill payments made through Airtel Money, such as payments for electricity, water, or airtime, may attract specific charges set by the jeweiligen utility provider. These charges can vary depending on the service provider and the payment amount.

By understanding the varying charges associated with different Airtel Money Uganda withdrawal transaction types, users can choose the most cost-effective option for their specific needs. This knowledge enables them to manage their finances wisely and minimize unnecessary expenses.

Promotions

Promotions and discounts offered by Airtel Uganda play a significant role in influencing withdrawal charges for Airtel Money Uganda users. These promotions can take various forms, including reduced fees, cashback offers, and loyalty rewards.

Understanding the connection between promotions and withdrawal charges is crucial for users to optimize their transactions and save money. By being aware of ongoing promotions, users can plan their withdrawals accordingly and take advantage of cost-saving opportunities.

For instance, Airtel Uganda may introduce a promotion offering a 50% discount on withdrawal charges for a limited period. During this promotional period, users can make withdrawals at a significantly reduced cost, effectively lowering their transaction expenses.

Loyalty programs and referral bonuses are other forms of promotions that can impact withdrawal charges. Airtel Uganda may offer reduced withdrawal charges or additional benefits to users who maintain a certain account balance or refer new customers to the service.

Staying informed about Airtel Uganda's promotions and discounts empowers users to make informed decisions, minimize withdrawal costs, and maximize the value of their Airtel Money accounts.

FAQs on Airtel Money Uganda Withdrawal Charges

This section provides answers to frequently asked questions (FAQs) regarding Airtel Money Uganda withdrawal charges, empowering users with the knowledge to make informed decisions and optimize their transactions.

Question 1: What factors influence Airtel Money Uganda withdrawal charges?

Withdrawal charges are determined by several factors, including the withdrawal amount, method, location, time of day, withdrawal frequency, account balance, transaction type, and applicable promotions.

Question 2: How can I minimize Airtel Money Uganda withdrawal charges?

To minimize charges, consider withdrawing larger amounts less frequently. Utilize Airtel agents instead of banks for withdrawals and take advantage of off-peak hours and promotions. Maintain a sufficient account balance to avoid minimum balance fees.

Question 3: Are there any hidden charges associated with Airtel Money Uganda withdrawals?

Typically, there are no hidden charges beyond the standard withdrawal fees. However, some agents may impose additional charges for night-time withdrawals or emergency services.

Question 4: Can I negotiate withdrawal charges with Airtel Money Uganda agents?

Negotiating withdrawal charges is generally not possible. However, some agents may offer reduced fees for bulk transactions or to loyal customers.

Question 5: What should I do if I encounter any issues with Airtel Money Uganda withdrawal charges?

In case of any discrepancies or concerns, contact Airtel Uganda customer care for assistance. Provide clear details of the transaction and any supporting documentation to facilitate a prompt resolution.

Question 6: How can I stay updated on the latest Airtel Money Uganda withdrawal charges and promotions?

Visit the official Airtel Uganda website, follow their social media channels, or subscribe to their email newsletter for the most up-to-date information on charges and promotions.

Understanding these FAQs equips Airtel Money Uganda users with the necessary knowledge to manage their withdrawals effectively, minimize costs, and maximize the benefits of the service.

Proceed to the next section for further insights.

Tips for Minimizing Airtel Money Uganda Withdrawal Charges

Prudent financial management involves optimizing transactions to reduce unnecessary expenses. Here are some valuable tips to help Airtel Money Uganda users minimize withdrawal charges:

Tip 1: Consolidate Withdrawals

Avoid making multiple small withdrawals. Instead, consolidate smaller amounts into larger, less frequent withdrawals. This reduces the cumulative charges incurred and saves money in the long run.

Tip 2: Utilize Airtel Agents

Withdrawals made through Airtel agents generally attract lower charges compared to withdrawals made through banks. Take advantage of the wider distribution of Airtel agents to save on withdrawal costs.

Tip 3: Plan Withdrawals During Off-Peak Hours

Airtel Uganda may charge different fees for withdrawals made at different times of the day or night. Plan withdrawals during off-peak hours, typically late evenings or early mornings, to avoid higher peak-hour charges.

Tip 4: Maintain a Sufficient Account Balance

Some Airtel Money agents or banks may impose a minimum balance requirement for withdrawals. Maintaining a sufficient account balance helps avoid higher fees associated with falling below the minimum balance.

Tip 5: Take Advantage of Promotions and Discounts

Airtel Uganda periodically offers promotions and discounts that impact withdrawal charges. Stay informed about these promotions and take advantage of them to save money on withdrawals.

Tip 6: Explore Alternative Withdrawal Methods

Consider alternative withdrawal methods, such as mobile money transfers or bank transfers, which may offer lower charges compared to cash withdrawals.

Tip 7: Negotiate with Agents (Optional)

In some cases, negotiating withdrawal charges with Airtel agents may be possible, especially for bulk transactions or for loyal customers. Approach negotiations politely and professionally.

Tip 8: Monitor Transactions Regularly

Keep track of your Airtel Money Uganda withdrawal transactions and charges. Regularly review your statements or transaction history to identify any discrepancies or excessive charges. Promptly report any concerns to Airtel Uganda customer care for resolution.

By implementing these tips, Airtel Money Uganda users can effectively manage their withdrawal charges, optimize their transactions, and maximize the value of their accounts.

Remember, responsible financial management involves making informed decisions and utilizing available resources wisely. By following these tips, you can minimize withdrawal costs and enhance your overall Airtel Money Uganda experience.

Conclusion

Airtel Money Uganda withdrawal charges are a crucial aspect of managing Airtel Money accounts effectively. Understanding the factors that influence these charges empowers users to make informed decisions and optimize their transactions. By considering the withdrawal amount, method, location, time, frequency, account balance, transaction type, and applicable promotions, users can minimize withdrawal costs and maximize the value of their Airtel Money accounts.

This exploration of Airtel Money Uganda withdrawal charges highlights the importance of financial literacy and responsible money management. By following the tips and strategies outlined in this article, users can effectively manage their withdrawals, avoid unnecessary charges, and enhance their overall Airtel Money Uganda experience.

- Unveiling Sabrina Carpenters Measurements Insights And Discoveries

- Unveiling Joran Van Der Sloots Height Exploring Insights And Surprising Revelations

- Scottie Schefflers Wifes Pregnancy Exclusive Revelations And Untold Stories

- Robert Prevost Donald Trump

- Rios Cerca De Mi

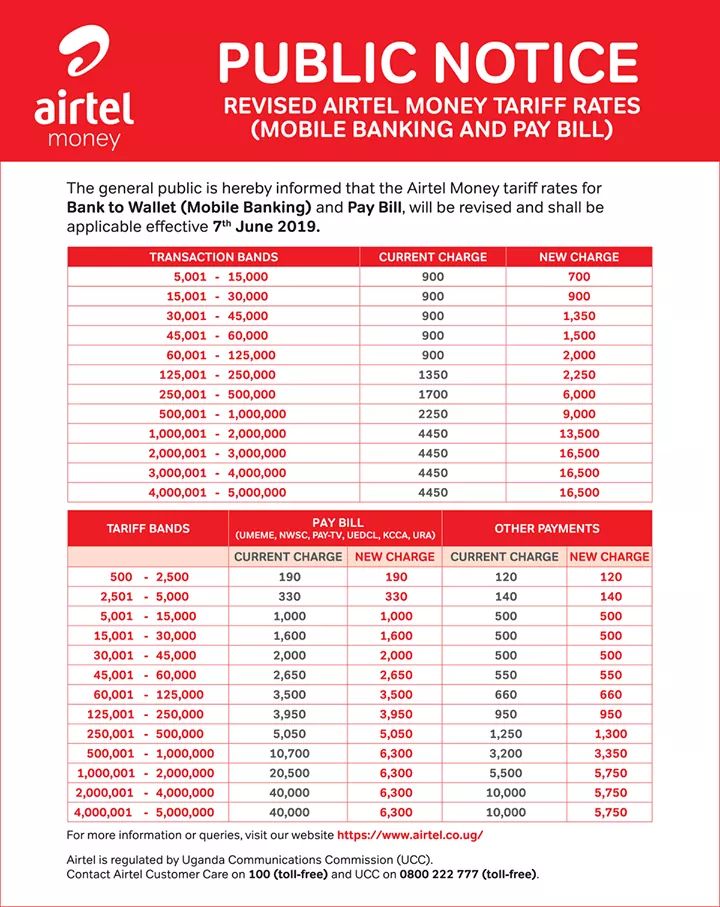

In Uganda, Airtel money charges in 2019, including mobile money to bank

The Airtel Money rates 2022 Techjaja