Uncover The Secrets Of Airtel Money Withdrawal Charges: Insights And Savings Revealed

Airtel Money withdrawal charges are the fees levied by Airtel when a customer withdraws money from their Airtel Money account. These charges vary depending on the amount being withdrawn and the method of withdrawal. For instance, withdrawing money from an Airtel Money agent incurs a lower fee than withdrawing from a bank.

Airtel Money withdrawal charges are important because they can affect the overall cost of using the service. Customers who frequently withdraw large amounts of money may want to consider using a method with lower fees. Airtel Money withdrawal charges can also vary depending on the country in which the service is being used.

Overall, Airtel Money withdrawal charges are a key factor to consider when using the service. Customers should be aware of the fees associated with different withdrawal methods and choose the option that best suits their needs.

- Jenna Lyons Height Surprising Truths And Fashion Revelations

- Unraveling The Mystery Ontario Brian Renaud Accident And Its Impact

- Bianca Lawson Unraveling The Enigma Of Motherhood

- Yailin La Mas Viral Xxx

- Unveiling The Visionary Impact Of Chris Carlos On Atlanta

Airtel Money Withdrawal Charges

Airtel Money withdrawal charges are the fees levied by Airtel when a customer withdraws money from their Airtel Money account. These charges vary depending on the amount being withdrawn and the method of withdrawal. For instance, withdrawing money from an Airtel Money agent incurs a lower fee than withdrawing from a bank.

- Amount: The amount of money being withdrawn is a key factor in determining the withdrawal charge.

- Method: The method of withdrawal also affects the charge. Withdrawing from an Airtel Money agent typically incurs a lower fee than withdrawing from a bank.

- Location: The country or region in which the withdrawal is being made can also affect the charge.

- Currency: The currency being withdrawn may also impact the charge.

- Account type: The type of Airtel Money account (e.g., personal, business) may also affect the charge.

- Transaction frequency: Customers who frequently withdraw large amounts of money may be able to negotiate lower fees with Airtel.

- Transaction limits: Airtel may impose limits on the amount of money that can be withdrawn per transaction or per day.

- Taxes: Withdrawal charges may be subject to taxes in some jurisdictions.

- Security: Airtel may charge a fee for additional security measures, such as two-factor authentication.

- Convenience: The convenience of the withdrawal method may also be a factor in determining the charge.

Overall, Airtel Money withdrawal charges are a key factor to consider when using the service. Customers should be aware of the fees associated with different withdrawal methods and choose the option that best suits their needs.

Amount

The amount of money being withdrawn is a key factor in determining the Airtel Money withdrawal charge. This is because Airtel typically charges a tiered fee structure, where the withdrawal charge increases as the amount of money being withdrawn increases. For example, Airtel may charge a flat fee of $1 for withdrawals of up to $100, and then an additional $1 for each additional $100 withdrawn. This means that withdrawing $200 would incur a withdrawal charge of $2, while withdrawing $500 would incur a withdrawal charge of $5.

- Unveiling The Captivating Life And Legacy Of Brian Boitanos Wife

- Unveiling The Origin Of Jamal Musiala Embracing Diversity And Inspiring Dreams

- Unveiling The Enigmatic Daniel Silber A Musical Journey Of Discovery

- Im Doing It Are You

- Monster High School Dress To Impress

- Facet 1: Understanding Tiered Fee Structures

Tiered fee structures are common in the financial industry, and they can have a significant impact on the cost of using a service. In the case of Airtel Money, the tiered fee structure for withdrawal charges incentivizes customers to withdraw smaller amounts of money more frequently, as this will result in lower overall withdrawal charges.

- Facet 2: Impact on Budgeting and Cash Flow

The amount of money being withdrawn can also have a significant impact on budgeting and cash flow. Withdrawing large amounts of money can deplete a customer's Airtel Money balance, which could make it difficult to meet other financial obligations. For this reason, it is important to carefully consider the amount of money that is being withdrawn and to ensure that it is in line with the customer's budget and cash flow needs.

- Facet 3: Exploring Alternative Withdrawal Methods

In some cases, customers may be able to avoid Airtel Money withdrawal charges by using alternative withdrawal methods. For example, customers may be able to withdraw money from their Airtel Money account to a linked bank account or mobile wallet without incurring a fee. Customers should explore all of their withdrawal options before making a decision.

Overall, the amount of money being withdrawn is a key factor to consider when using Airtel Money. Customers should be aware of the tiered fee structure for withdrawal charges and should consider their budget and cash flow needs before making a withdrawal.

Method

The method of withdrawal is a key factor in determining the Airtel Money withdrawal charge. This is because Airtel has different partnerships with different withdrawal agents, and these partnerships affect the cost of withdrawal. For example, Airtel may have a partnership with a certain bank that allows customers to withdraw money from their Airtel Money account to their bank account without incurring a fee. However, withdrawing money from an Airtel Money agent may incur a small fee.

In general, withdrawing money from an Airtel Money agent is the most convenient and cost-effective method. This is because Airtel Money agents are widely available, and they typically charge lower fees than banks. However, it is important to note that the withdrawal fee may vary depending on the agent. For example, some agents may charge a flat fee for all withdrawals, while others may charge a percentage of the amount being withdrawn.

Customers should compare the withdrawal fees of different agents before choosing a method. They should also consider the convenience of each method and choose the one that best suits their needs.

Overall, the method of withdrawal is an important factor to consider when using Airtel Money. Customers should be aware of the different withdrawal methods and the associated fees before making a withdrawal.

Location

Airtel Money withdrawal charges can vary depending on the country or region in which the withdrawal is being made. This is because the cost of providing Airtel Money services can vary from country to country. For example, Airtel may have to pay higher operating costs in countries with less developed infrastructure. Additionally, Airtel may have to comply with different regulatory requirements in different countries, which can also affect the cost of providing Airtel Money services.

- Facet 1: Currency Exchange Rates

The currency exchange rate between the country in which the Airtel Money account is held and the country in which the withdrawal is being made can also affect the withdrawal charge. For example, if the value of the currency in the country in which the withdrawal is being made is lower than the value of the currency in the country in which the Airtel Money account is held, then the withdrawal charge will be higher.

- Facet 2: Local Taxes and Regulations

Local taxes and regulations can also affect Airtel Money withdrawal charges. For example, some countries may impose a value-added tax (VAT) on Airtel Money withdrawals. Additionally, some countries may have regulations that limit the amount of money that can be withdrawn from an Airtel Money account per day or per month.

- Facet 3: Availability of Airtel Money Agents

The availability of Airtel Money agents in a particular country or region can also affect the withdrawal charge. In areas where there are a limited number of Airtel Money agents, the withdrawal charge may be higher. This is because Airtel has to pay a higher commission to agents in these areas.

- Facet 4: Economic and Political Stability

The economic and political stability of a country or region can also affect Airtel Money withdrawal charges. In countries that are experiencing economic or political instability, the withdrawal charge may be higher. This is because Airtel has to take into account the risk of fraud and currency devaluation.

Overall, the location of the withdrawal is an important factor to consider when using Airtel Money. Customers should be aware of the different withdrawal charges that may apply in different countries or regions.

Currency

The currency being withdrawn can impact the Airtel Money withdrawal charge due to currency exchange rates. When withdrawing money from an Airtel Money account in a currency other than the account's base currency, the withdrawal amount will be converted using the prevailing exchange rate. This conversion can result in additional charges, especially if the exchange rate is unfavorable.

For example, if a customer has an Airtel Money account in Kenyan shillings (KES) and wants to withdraw money in US dollars (USD), the withdrawal amount will be converted from KES to USD using the current exchange rate. If the exchange rate is 1 USD = 100 KES, and the customer wants to withdraw 100 USD, they will be charged an additional 10,000 KES to cover the currency conversion.

Customers should be aware of the currency exchange rates when withdrawing money from their Airtel Money accounts. They should also consider using a currency converter to compare the exchange rates offered by different banks and money transfer services to ensure they get the best possible rate.

Overall, the currency being withdrawn is an important factor to consider when using Airtel Money. Customers should be aware of the currency exchange rates and the potential impact on the withdrawal charge.

Account type

The type of Airtel Money account can affect the withdrawal charge due to different account features, usage patterns, and regulatory requirements.

- Facet 1: Personal vs. Business Accounts

Personal Airtel Money accounts are typically designed for individual use, while business accounts are for businesses and organizations. Business accounts may have higher withdrawal charges than personal accounts due to the higher transaction volumes and the need for additional features such as multiple users and advanced reporting.

- Facet 2: Account Balance and Transaction Frequency

Airtel Money accounts with higher account balances and more frequent transactions may be eligible for lower withdrawal charges. This is because Airtel may offer tiered pricing based on account activity, rewarding customers who maintain higher balances and conduct more transactions.

- Facet 3: Regulatory Compliance

The type of Airtel Money account can also affect the withdrawal charge due to regulatory compliance requirements. For example, business accounts may be subject to additional Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, which can result in higher withdrawal charges.

- Facet 4: Account Features and Services

Airtel Money accounts with additional features and services may have higher withdrawal charges. For example, accounts that offer overdraft protection or insurance may incur additional charges to cover the cost of these services.

Overall, the type of Airtel Money account can affect the withdrawal charge due to a combination of factors, including account features, usage patterns, and regulatory requirements. Customers should consider the type of account that best suits their needs and budget when choosing an Airtel Money account.

Transaction frequency

Transaction frequency is an important factor that can affect Airtel Money withdrawal charges. Customers who frequently withdraw large amounts of money may be able to negotiate lower fees with Airtel. This is because Airtel is more likely to offer discounts to customers who are loyal and generate a high volume of transactions.

For example, a customer who withdraws $1,000 once a month may be charged a higher withdrawal fee than a customer who withdraws $1,000 every week. This is because the customer who withdraws money more frequently is more valuable to Airtel. They are more likely to use Airtel Money for other services, such as sending money to friends and family or paying bills. As a result, Airtel is more willing to offer them a lower withdrawal fee.

Customers who want to negotiate lower Airtel Money withdrawal charges should contact Airtel customer service. They should be prepared to provide information about their transaction history and their average withdrawal amount. Airtel may be willing to offer a discount to customers who are willing to commit to a certain number of withdrawals per month or year.

Negotiating lower Airtel Money withdrawal charges can save customers a significant amount of money. Customers who frequently withdraw large amounts of money should contact Airtel customer service to see if they can get a discount.

Transaction limits

Transaction limits are an important aspect of Airtel Money withdrawal charges. These limits can affect how much money customers can withdraw at one time and how much money they can withdraw in a single day. Airtel may impose these limits for a variety of reasons, including security, fraud prevention, and regulatory compliance.

- Facet 1: Security

Transaction limits help to protect customers from fraud and theft. By limiting the amount of money that can be withdrawn at one time, Airtel makes it more difficult for fraudsters to steal large sums of money from customers' accounts.

- Facet 2: Fraud prevention

Transaction limits can also help to prevent fraud by limiting the amount of money that can be withdrawn in a single day. This makes it more difficult for fraudsters to withdraw large sums of money from customers' accounts without being detected.

- Facet 3: Regulatory compliance

Airtel may also impose transaction limits to comply with regulatory requirements. In some countries, there are limits on the amount of money that can be withdrawn from a mobile money account per day or per month. Airtel must comply with these regulations in order to operate in these countries.

- Facet 4: Customer convenience

Transaction limits can also be used to improve customer convenience. By limiting the amount of money that can be withdrawn at one time, Airtel can help to reduce the risk of customers losing their money if their phone is lost or stolen.

Transaction limits can have a significant impact on how customers use Airtel Money. Customers who need to withdraw large amounts of money may need to plan ahead and make multiple withdrawals over several days. Customers who are concerned about security may want to set lower transaction limits on their accounts. Overall, transaction limits are an important aspect of Airtel Money withdrawal charges that customers should be aware of.

Taxes

Taxes can be a significant factor in determining the overall cost of using Airtel Money. In some jurisdictions, withdrawal charges may be subject to value-added tax (VAT) or other forms of taxation. This means that customers may have to pay an additional amount on top of the standard withdrawal charge.

- Facet 1: Impact on Withdrawal Costs

The impact of taxes on withdrawal charges can vary depending on the jurisdiction and the amount of money being withdrawn. In some cases, the tax may be a small percentage of the withdrawal amount, while in other cases it may be a more significant amount. Customers should be aware of the tax implications of withdrawing money from their Airtel Money account before making a withdrawal.

- Facet 2: Compliance with Tax Regulations

Airtel is required to comply with the tax laws and regulations of the jurisdictions in which it operates. This means that Airtel must collect and remit taxes on withdrawal charges where applicable. Customers should be assured that Airtel is taking all necessary steps to comply with its tax obligations.

- Facet 3: Customer Responsibility

It is the responsibility of customers to declare and pay any taxes that may be due on their Airtel Money withdrawals. Customers should consult with a tax advisor to determine their tax obligations.

- Facet 4: Transparency and Disclosure

Airtel is committed to being transparent and providing customers with clear information about its withdrawal charges, including any applicable taxes. Customers can find more information about taxes on Airtel Money withdrawal charges by visiting the Airtel website or contacting Airtel customer service.

Taxes are an important consideration when using Airtel Money. Customers should be aware of the tax implications of withdrawing money from their Airtel Money account and should consult with a tax advisor if necessary.

Security

The implementation of additional security measures, such as two-factor authentication, is a crucial aspect of Airtel Money withdrawal charges. Employing these measures enhances the overall security of customer accounts and transactions, mitigating the risks associated with unauthorized access or fraudulent activities.

- Enhanced Account Protection

Two-factor authentication adds an extra layer of security to Airtel Money accounts. By requiring users to provide an additional form of verification, such as a one-time password (OTP) sent via SMS or email, it becomes significantly more difficult for unauthorized individuals to access and withdraw funds from an account.

- Reduced Fraudulent Transactions

Two-factor authentication acts as a deterrent against fraudulent transactions. Even if a fraudster obtains a user's login credentials, they will be unable to complete a withdrawal without access to the additional verification factor, such as the OTP. This significantly reduces the likelihood of successful fraudulent withdrawals.

- Compliance with Regulations

Airtel's implementation of additional security measures, including two-factor authentication, demonstrates its commitment to adhering to industry regulations and best practices. By meeting or exceeding regulatory requirements, Airtel ensures the safety and integrity of its platform and customer transactions.

- Customer Confidence and Trust

Offering robust security measures, such as two-factor authentication, instills confidence and trust among Airtel Money users. Customers feel more secure knowing that their accounts and funds are protected against unauthorized access and fraudulent activities, encouraging them to continue using the service.

In conclusion, the implementation of additional security measures, such as two-factor authentication, is inextricably linked to Airtel Money withdrawal charges. By prioritizing the security of customer accounts and transactions, Airtel not only safeguards its users' funds but also maintains their trust and confidence in the platform. These measures ultimately contribute to the overall reliability and integrity of Airtel Money services.

Convenience

The convenience of the withdrawal method is often a key consideration for customers when choosing how to withdraw money from their Airtel Money accounts. Different withdrawal methods offer varying levels of convenience, and these differences can impact the associated charges.

- Agent Network

Withdrawing money from Airtel Money agents is generally considered convenient, as agents are widely available in many locations. However, the convenience of this method may come at a cost, as agents often charge a fee for their services. This fee can vary depending on the agent and the amount of money being withdrawn.

- Bank Withdrawal

Withdrawing money from an Airtel Money account to a bank account can be a convenient option for those who prefer to keep their funds in a traditional bank. However, this method may also incur a fee, depending on the bank and the transaction amount. Additionally, bank withdrawals may take longer to process compared to other methods.

- Mobile Withdrawal

Withdrawing money from an Airtel Money account directly to a mobile wallet or bank account using a mobile device is becoming increasingly popular due to its convenience. This method often involves using a mobile app or USSD code, and it can be faster and more convenient than traditional methods. However, mobile withdrawals may also incur a fee, depending on the service provider and the transaction amount.

- International Withdrawals

Withdrawing money from an Airtel Money account in one country to another country can be convenient for those who frequently send money abroad. However, international withdrawals typically incur higher fees compared to domestic withdrawals. These fees can vary depending on the destination country and the amount being withdrawn.

Ultimately, the convenience of the withdrawal method should be weighed against the associated charges when choosing how to withdraw money from an Airtel Money account. Customers should consider their individual needs and preferences to determine the most suitable and cost-effective withdrawal method.

Frequently Asked Questions about Airtel Money Withdrawal Charges

Understanding Airtel Money withdrawal charges is essential for customers who rely on this service to access their funds. Here are answers to some commonly asked questions to provide clarity and guidance:

Question 1: What factors determine Airtel Money withdrawal charges?

Airtel Money withdrawal charges can vary based on several factors, including the withdrawal method, the amount being withdrawn, the location of the withdrawal, the currency being withdrawn, the type of Airtel Money account, and the transaction frequency.

Question 2: What are the different withdrawal methods and their associated charges?

Customers can withdraw money from their Airtel Money account through various methods such as Airtel Money agents, bank withdrawals, mobile withdrawals, and international withdrawals. The charges for these methods vary depending on the agent, bank, or service provider involved.

Question 3: How do I minimize Airtel Money withdrawal charges?

To minimize Airtel Money withdrawal charges, customers can opt for methods with lower fees, such as withdrawing from Airtel Money agents or using mobile withdrawal services. Additionally, negotiating with Airtel customer service for lower charges may be possible for customers who frequently withdraw large amounts.

Question 4: What are the security measures in place for Airtel Money withdrawals?

Airtel Money employs robust security measures to protect customer accounts and transactions. These measures include two-factor authentication, transaction limits, and compliance with regulatory requirements. Airtel is committed to safeguarding customer funds and preventing unauthorized access.

Question 5: How can I stay informed about Airtel Money withdrawal charges?

Customers are advised to regularly check the official Airtel website, contact Airtel customer service, or visit Airtel retail stores for the most up-to-date information on Airtel Money withdrawal charges. Airtel strives to provide transparent and accessible information to its customers.

Question 6: What should I do if I encounter any issues with Airtel Money withdrawal charges?

In case of any concerns or issues related to Airtel Money withdrawal charges, customers should promptly contact Airtel customer service. Airtel's dedicated support team is available to assist with inquiries, resolve disputes, and provide guidance to ensure a seamless experience for customers.

Understanding and managing Airtel Money withdrawal charges is crucial for customers to make informed decisions and optimize their financial transactions. By addressing these frequently asked questions, Airtel aims to empower customers with the necessary knowledge and support to utilize Airtel Money services effectively.

For further inquiries or assistance, please reach out to Airtel customer service through the available channels.

Tips to Optimize Airtel Money Withdrawal Charges

Understanding and optimizing Airtel Money withdrawal charges can enhance the overall experience of using the service. Here are some valuable tips to consider:

Tip 1: Choose the Most Cost-Effective Withdrawal Method

Different withdrawal methods incur varying charges. Opting for methods with lower fees, such as withdrawing from Airtel Money agents or utilizing mobile withdrawal services, can help minimize overall costs.

Tip 2: Withdraw Larger Amounts Less Frequently

Airtel Money withdrawal charges may be structured such that withdrawing larger amounts less frequently can be more cost-effective than making multiple smaller withdrawals.

Tip 3: Negotiate with Airtel for Lower Charges

Customers who frequently withdraw substantial amounts may consider negotiating with Airtel customer service to potentially secure lower withdrawal charges.

Tip 4: Take Advantage of Promotions and Discounts

Airtel may offer promotions or discounts on withdrawal charges from time to time. Staying informed about these offers can lead to cost savings.

Tip 5: Utilize Airtel Money Services to Reduce Withdrawal Needs

By utilizing other Airtel Money services, such as mobile money transfers or bill payments, customers can reduce the frequency of cash withdrawals, potentially lowering overall withdrawal charges.

Incorporating these tips into your Airtel Money usage can help optimize withdrawal charges and enhance the service's overall value.

For further inquiries or assistance, please reach out to Airtel customer service through the available channels.

Airtel Money Withdrawal Charges

Airtel Money withdrawal charges are an integral aspect of using the Airtel Money service. This article has thoroughly explored the various factors that influence these charges and provided valuable tips to optimize them. Understanding the key factors, such as withdrawal method, amount, location, and transaction frequency, empowers customers to make informed decisions and minimize costs.

Airtel Money is committed to providing a convenient and secure mobile money service. By optimizing withdrawal charges, customers can enhance their overall experience and maximize the benefits of Airtel Money. Regular monitoring of charges, leveraging cost-effective methods, and utilizing Airtel Money's diverse services can lead to significant savings and a more efficient financial management. Airtel Money's dedication to transparency and customer support ensures that users have the necessary information and assistance to make the most of their Airtel Money accounts.

- I Just Lost My Dawg Lyrics

- Unveiling Todd Haleys Net Worth Uncovering Secrets And Strategies

- Unveiling Sabrina Carpenters Measurements Insights And Discoveries

- Unveiling The Reasons Behind Mariahs Departure From Married To Medicine A Journey Of Discovery

- Unveiling The Visionary Impact Of Chris Carlos On Atlanta

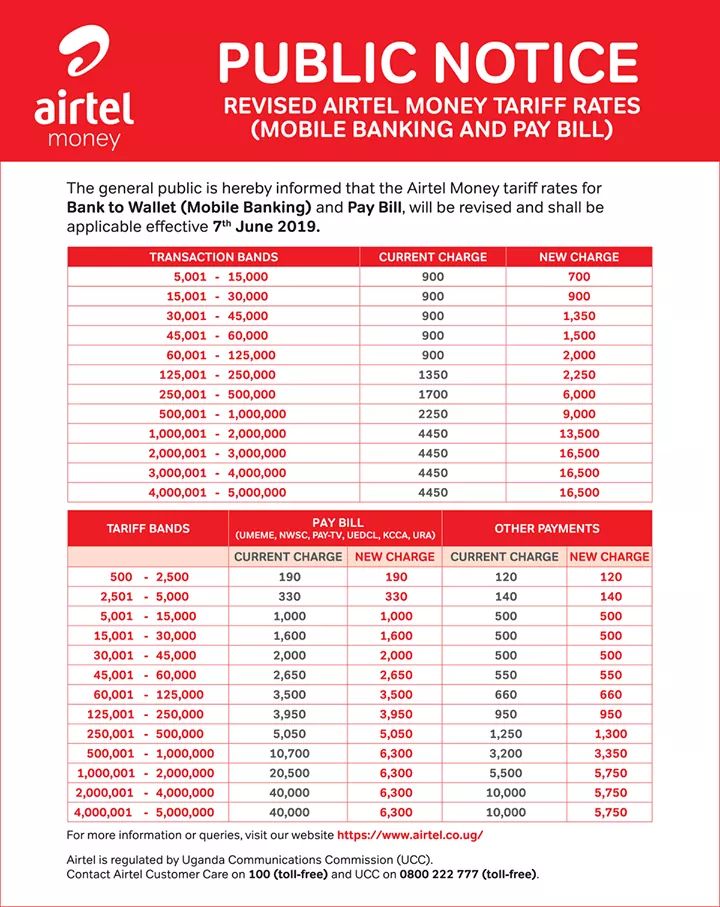

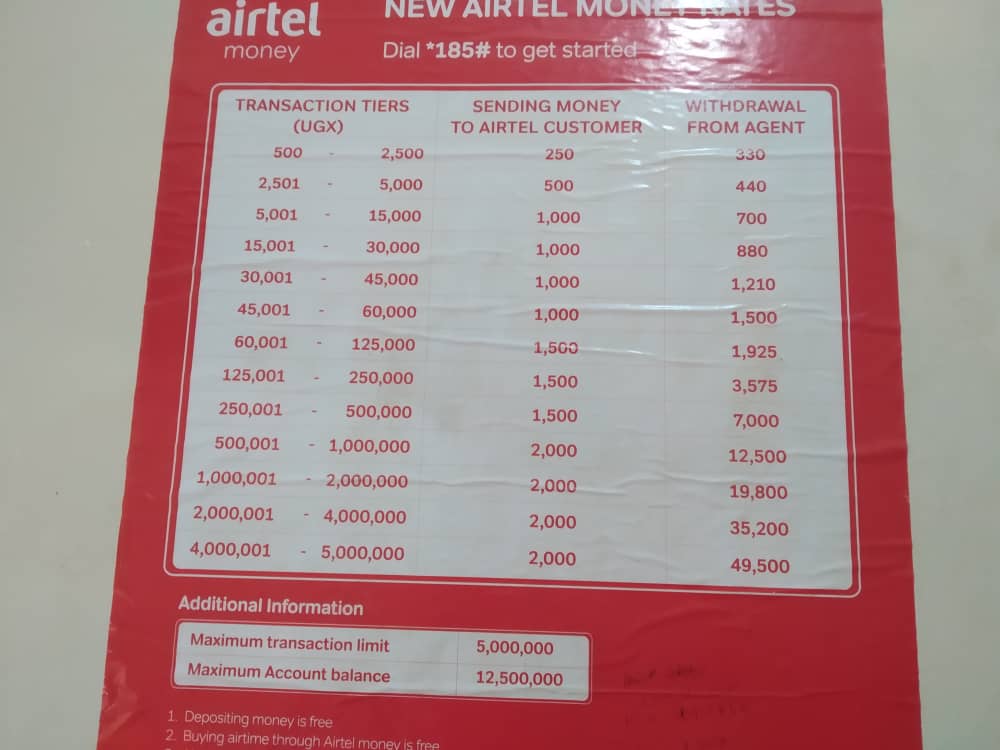

In Uganda, Airtel money charges in 2019, including mobile money to bank

See Airtel Money rates/Airtel Money charges 2019 in Uganda SautiTech