Unveiling Airtel Money Withdrawal Charges: Discover Hidden Secrets And Save!

Airtel Money withdrawal charges refer to the fees levied by Airtel, a leading telecommunications provider in Africa, for withdrawing funds from an Airtel Money account.

These charges vary depending on the withdrawal method used, such as ATM withdrawal, mobile money transfer, or bank transfer. Understanding these charges is crucial for Airtel Money users to manage their finances effectively.

Airtel Money withdrawal charges are generally minimal, making it a convenient and affordable way to access funds. Additionally, Airtel offers various promotions and loyalty programs that can further reduce these charges, providing cost savings to customers.

- Unveiling Todd Haleys Net Worth Uncovering Secrets And Strategies

- Unveil The Enchanting World Of Zach Galifianakis Beloved

- Unveiling The Enigma Uncover The Secrets Behind Honey Where Are My Handcuffs

- Uncover Micah Richards Partner Inside Their Thriving Relationship

- Uncover The Secrets And Symbolism Of The Welcome To Death Row Meme

Airtel Money Withdrawal Charges

Understanding Airtel Money withdrawal charges is essential for managing your finances effectively when using this popular mobile money service. Here are eight key aspects to consider:

- Amount: The withdrawal charge varies depending on the amount being withdrawn.

- Method: Different withdrawal methods, such as ATM, mobile money, or bank transfer, have different charges.

- Location: Withdrawal charges may vary depending on the country or region where the withdrawal is made.

- Time: Some withdrawals, such as late-night ATM withdrawals, may incur higher charges.

- Network: Airtel Money withdrawals made on other networks may incur additional charges.

- Transaction limits: Daily or monthly transaction limits may apply, and exceeding these limits may result in higher charges.

- Promotions: Airtel often offers promotions and discounts on withdrawal charges, so it's worth checking for these before making a withdrawal.

- Account balance: Maintaining a higher Airtel Money account balance may qualify you for lower withdrawal charges.

Understanding these key aspects will help you make informed decisions about your Airtel Money withdrawals and minimize potential charges. By choosing the right withdrawal method, timing, and amount, you can save money and make the most of your Airtel Money account.

Amount

The amount being withdrawn is a key factor that determines the Airtel Money withdrawal charge. Generally, the higher the withdrawal amount, the higher the charge. This is because Airtel incurs higher operational costs for processing larger withdrawals, including secure transportation and verification procedures.

- Uncover The Thrilling World Of Cambodian Sports With Khmer Sport News

- Unveiling The Reasons Behind Mariahs Departure From Married To Medicine A Journey Of Discovery

- Unveiling The Brilliance Of Noma Dumezweni A Journey Of Discovery

- Unveiling The Life And Legacy Of Nate Bossi Discoveries And Insights Within

- Aaron Earned An Iron Urn

Understanding this connection is crucial for budgeting and managing your Airtel Money account effectively. For instance, if you need to withdraw a large amount of money, you may want to consider doing so through a bank transfer, which typically has lower charges compared to ATM withdrawals.

Additionally, Airtel may offer tiered withdrawal charges based on the amount withdrawn. For example, there could be a lower charge for withdrawals below a certain amount, and a higher charge for withdrawals above that amount. Being aware of these tiers can help you optimize your withdrawals and minimize charges.

By considering the amount being withdrawn when making Airtel Money withdrawals, you can make informed decisions and choose the most cost-effective method for your needs.

Method

The withdrawal method you choose significantly impacts the charges associated with your Airtel Money withdrawal. Each method involves varying levels of operational costs and security measures, which are reflected in the charges.

- ATM Withdrawals

ATM withdrawals typically incur higher charges compared to other methods. This is because Airtel incurs costs for maintaining and operating ATMs, including cash handling, security, and network connectivity.

- Mobile Money Transfers

Mobile money transfers usually have lower charges than ATM withdrawals. This is because mobile money transactions are processed electronically, eliminating the need for physical cash handling and ATM maintenance costs.

- Bank Transfers

Bank transfers often have the lowest charges among the withdrawal methods. This is because banks have established infrastructure and partnerships for interbank transfers, reducing operational costs.

By understanding the charges associated with each withdrawal method, you can make informed decisions and choose the option that best suits your needs and minimizes costs.

Location

The location of your Airtel Money withdrawal can impact the charges you incur. This is primarily due to varying regulatory requirements, operational costs, and currency exchange rates across different countries and regions.

For instance, Airtel may have to comply with specific regulations and security measures in certain countries, which can lead to higher withdrawal charges. Additionally, the cost of operating and maintaining Airtel Money services can vary depending on the region, affecting the withdrawal charges.

Understanding the connection between location and Airtel Money withdrawal charges is crucial for budgeting and planning your withdrawals effectively. By being aware of potential variations in charges based on your location, you can make informed decisions and choose the most cost-effective withdrawal options.

Time

The timing of your Airtel Money withdrawal can impact the charges you incur. This is particularly true for late-night ATM withdrawals, which may attract higher charges compared to withdrawals made during regular business hours.

- Increased Operational Costs

Late-night ATM withdrawals require additional operational costs for Airtel. ATMs need to be monitored and replenished more frequently during late hours, and security measures may be enhanced to ensure the safety of customers.

- Reduced Availability of Cash

ATMs may run out of cash more frequently during late nights due to fewer replenishment schedules. This can lead to failed withdrawal attempts and potential charges for unsuccessful transactions.

- Security Considerations

Late-night ATM withdrawals may pose higher security risks due to reduced visibility and increased vulnerability to fraud. Airtel may impose higher charges to cover the costs of enhanced security measures, such as increased surveillance and fraud monitoring.

- Convenience Premium

The convenience of accessing cash during late hours comes with a premium. Airtel may charge higher fees to offset the additional costs associated with providing this extended service.

Understanding the connection between time and Airtel Money withdrawal charges allows you to plan your withdrawals effectively. By avoiding late-night ATM withdrawals or opting for alternative withdrawal methods during those hours, you can potentially minimize the charges incurred.

Network

Understanding the connection between network and Airtel Money withdrawal charges is crucial for managing your finances effectively. When you make an Airtel Money withdrawal on a network other than Airtel's, you may incur additional charges. This is because Airtel has to pay a fee to the other network for processing the transaction. The amount of the charge can vary depending on the network and the amount of money being withdrawn.

For example, if you withdraw Airtel Money from an M-Pesa agent, you may be charged a fee of 1% of the transaction amount. This is because M-Pesa is a different network from Airtel, and Airtel has to pay M-Pesa a fee for processing the transaction.

It's important to be aware of these additional charges before making an Airtel Money withdrawal on another network. By understanding the connection between network and Airtel Money withdrawal charges, you can make informed decisions about how to withdraw your money and minimize the fees you pay.

Transaction limits

Transaction limits are an important aspect of Airtel Money withdrawal charges. Airtel may impose daily or monthly limits on the amount of money that can be withdrawn from an Airtel Money account. These limits are in place to manage risk, prevent fraud, and ensure the stability of the Airtel Money platform.

Exceeding these transaction limits can result in higher charges. This is because Airtel needs to take additional steps to process withdrawals that exceed the limits, such as manual verification or increased security checks. These additional steps incur additional costs, which are passed on to the customer in the form of higher withdrawal charges.

Understanding the connection between transaction limits and Airtel Money withdrawal charges is important for managing your finances effectively. By being aware of the limits and the potential charges for exceeding them, you can plan your withdrawals accordingly and avoid unnecessary fees.

Promotions

Promotions and discounts are an integral part of Airtel Money withdrawal charges. Airtel frequently offers promotions and discounts on withdrawal charges to encourage customers to use their services and increase transaction volume. These promotions can significantly reduce withdrawal fees, providing cost savings to customers.

The connection between promotions and Airtel Money withdrawal charges is crucial for managing finances effectively. By being aware of these promotions and discounts, customers can plan their withdrawals to take advantage of the cost savings. Checking for promotions before making a withdrawal is essential to minimize withdrawal charges and optimize Airtel Money usage.

For instance, Airtel may offer a promotion that waives withdrawal charges for the first three withdrawals each month. Understanding this promotion can help customers time their withdrawals to avoid incurring charges. Additionally, Airtel may offer discounts on withdrawal charges during specific periods or for certain withdrawal amounts. Being informed about these promotions allows customers to make informed decisions and reduce their withdrawal costs.

In conclusion, promotions and discounts on Airtel Money withdrawal charges provide valuable opportunities for customers to save money on their transactions. By understanding the connection between promotions and withdrawal charges, customers can proactively manage their finances, take advantage of cost-saving opportunities, and maximize the benefits of using Airtel Money.

Account balance

The connection between account balance and Airtel Money withdrawal charges is significant for effective financial management. Airtel often implements tiered withdrawal charge structures, where customers with higher account balances qualify for lower withdrawal charges. This is because Airtel incurs lower operational costs for processing withdrawals from accounts with higher balances, as these accounts typically involve less risk and require fewer manual interventions.

For instance, Airtel may offer lower withdrawal charges for customers who maintain an average daily balance of $50 or more. By maintaining a higher account balance, customers can effectively reduce their withdrawal costs and optimize their Airtel Money usage. Additionally, higher account balances may also qualify customers for exclusive promotions and loyalty programs that further reduce withdrawal charges.

Understanding the connection between account balance and Airtel Money withdrawal charges is crucial for managing finances effectively. By maintaining a higher account balance, customers can proactively reduce their withdrawal costs, take advantage of cost-saving opportunities, and maximize the benefits of using Airtel Money.

FAQs on Airtel Money Withdrawal Charges

This section aims to address frequently asked questions and clarify common misconceptions regarding Airtel Money withdrawal charges.

Question 1: What factors influence Airtel Money withdrawal charges?

Airtel Money withdrawal charges can vary based on several factors, including the withdrawal amount, withdrawal method, location, time of withdrawal, network, transaction limits, promotions, and account balance.

Question 2: Why are withdrawal charges higher for larger amounts?

Processing larger withdrawals incurs higher operational costs for Airtel, including secure transportation and verification procedures. Thus, withdrawal charges tend to increase proportionally with the withdrawal amount.

Question 3: Which withdrawal method offers the lowest charges?

Generally, bank transfers have the lowest withdrawal charges compared to ATM withdrawals and mobile money transfers. However, charges may vary depending on specific factors.

Question 4: Can withdrawal charges vary based on location?

Yes, withdrawal charges may differ across countries or regions due to varying regulatory requirements, operational costs, and currency exchange rates.

Question 5: Are there additional charges for exceeding transaction limits?

Exceeding daily or monthly transaction limits may result in higher withdrawal charges to cover the additional processing costs and risk management measures.

Question 6: How can I minimize Airtel Money withdrawal charges?

To minimize withdrawal charges, consider withdrawing smaller amounts, using bank transfers or mobile money transfers, taking advantage of promotions and discounts, maintaining a higher account balance, and avoiding withdrawals during late hours or on other networks.

Summary: Understanding Airtel Money withdrawal charges and the factors that influence them is crucial for effective financial management. By optimizing withdrawal strategies and leveraging cost-saving opportunities, users can minimize charges and maximize the benefits of using Airtel Money.

Transition to the next section: For further inquiries or assistance, please contact Airtel's customer support channels.

Tips to Minimize Airtel Money Withdrawal Charges

Understanding Airtel Money withdrawal charges and implementing effective strategies can help you save money and manage your finances efficiently. Here are some valuable tips to consider:

Tip 1: Optimize Withdrawal Amount: When making an Airtel Money withdrawal, consider withdrawing smaller amounts to minimize charges. Larger withdrawals typically incur higher fees due to increased operational costs.

Tip 2: Choose Cost-Effective Withdrawal Methods: Bank transfers often have lower withdrawal charges compared to ATM withdrawals and mobile money transfers. Opting for bank transfers can help you reduce withdrawal costs.

Tip 3: Leverage Promotions and Discounts: Airtel frequently offers promotions and discounts on withdrawal charges. Take advantage of these offers by checking for active promotions before making a withdrawal.

Tip 4: Maintain a Higher Account Balance: Maintaining a higher Airtel Money account balance may qualify you for lower withdrawal charges. Airtel often implements tiered charge structures that favor customers with higher account balances.

Tip 5: Avoid Late-Night ATM Withdrawals: Late-night ATM withdrawals may attract higher charges due to increased operational costs and security measures. Plan your withdrawals during regular business hours to avoid these additional fees.

Summary: By following these tips, you can effectively minimize Airtel Money withdrawal charges, optimize your financial management, and maximize the benefits of using Airtel Money services.

Conclusion: Understanding Airtel Money withdrawal charges and implementing these practical tips can help you save money and make the most of your Airtel Money account. Remember to stay informed about any changes or updates to the withdrawal charges policy by referring to Airtel's official channels.

Conclusion on Airtel Money Withdrawal Charges

In summary, Airtel Money withdrawal charges are an essential aspect of managing your finances effectively when using this mobile money service. Understanding the various factors that influence these charges, such as withdrawal amount, method, location, and promotions, empowers you to make informed decisions and optimize your withdrawals.

By implementing practical tips like withdrawing smaller amounts, choosing cost-effective methods, leveraging promotions, and maintaining a higher account balance, you can minimize withdrawal charges and maximize the benefits of using Airtel Money. Staying informed about any changes or updates to the withdrawal charges policy is also crucial for effective financial management.

- Unveiling The Cinematic Treasures Of Lone Pine A Western Odyssey With James Marsden

- Unveiling The Truth Sonya Millers Journey Survivor Advocate And Master Ps Exwife

- Unveil The Latest Sports News And Discoveries For February 4 2024

- Unveiling The Timeless Legacy A Journey Through Ilayarajas Age

- Unveiling The Unbreakable Bond Mark Wahlberg And Reese Witherspoons Enduring Friendship

The Airtel Money rates 2022 Techjaja

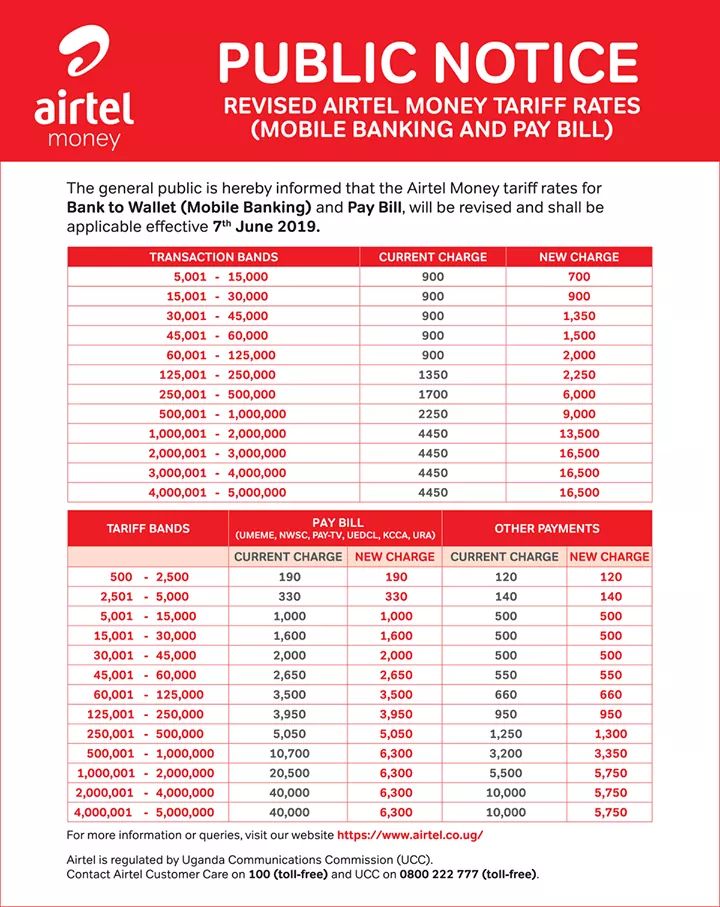

In Uganda, Airtel money charges in 2019, including mobile money to bank