Unveiling The Secrets Of Airtel Withdraw Charges: Discover And Optimize

Airtel Withdraw Charges

Airtel Withdraw Charges refer to the fees levied by Airtel, a telecommunications company, for withdrawing money from its Airtel Payments Bank account. These charges vary depending on the withdrawal method used, such as ATM withdrawals, over-the-counter withdrawals, or UPI transactions. Airtel Withdraw Charges are typically a percentage of the withdrawal amount, with a minimum charge applicable. They are imposed to cover the costs associated with processing the withdrawal transaction and maintaining the Airtel Payments Bank infrastructure.

Understanding Airtel Withdraw Charges is crucial for customers to manage their finances effectively. By being aware of these charges, customers can plan their withdrawals accordingly to minimize the impact on their overall balance. Airtel provides transparent information about its Withdraw Charges on its official website and mobile application, enabling customers to make informed decisions before initiating a withdrawal transaction.

- Bianca Lawson Unraveling The Enigma Of Motherhood

- Uncover The Secrets Of Skip The Game Odessa A Journey Of Discovery

- Andrew Kojis Wife Uncovering The Hidden Truth

- Unveiling The Brilliance Of Noma Dumezweni A Journey Of Discovery

- Unveiling The Captivating Life And Legacy Of Brian Boitanos Wife

Airtel Withdraw Charges

Airtel Withdraw Charges are fees levied by Airtel for withdrawing money from its Airtel Payments Bank account. These charges are an essential aspect of managing finances and understanding them is crucial for customers.

- Transaction Type: Charges vary based on the withdrawal method (ATM, over-the-counter, UPI).

- Charge Percentage: A percentage of the withdrawal amount is charged.

- Minimum Charge: A minimum charge applies regardless of the withdrawal amount.

- Transaction Limit: Daily and monthly transaction limits may apply.

- Convenience Fee: Some withdrawal methods may incur an additional convenience fee.

- Bank Charges: Additional charges may be levied by the bank associated with the ATM or withdrawal location.

- Account Balance: Charges are deducted from the Airtel Payments Bank account balance.

- Transaction Receipt: Customers receive a receipt for each withdrawal transaction.

- Transaction History: Airtel provides a detailed transaction history for tracking withdrawals.

- Customer Support: Airtel offers customer support for any queries or issues related to Withdraw Charges.

Understanding these key aspects enables customers to plan their withdrawals effectively, minimize charges, and manage their Airtel Payments Bank account efficiently. Airtel's transparent policies and easily accessible information empower customers to make informed decisions regarding their financial transactions.

Transaction Type

The type of transaction chosen for withdrawing funds from an Airtel Payments Bank account significantly impacts the applicable Airtel Withdraw Charges. Understanding the variations in charges based on different withdrawal methods is crucial for optimizing financial management.

- Uncovering The Heartwarming Story Mike Miles Parents Meet Mother Jeanee Miles

- Uncover Micah Richards Partner Inside Their Thriving Relationship

- Unraveling The Mystery Ontario Brian Renaud Accident And Its Impact

- Meet Ray Fishers Wife An Inspiring Force In Her Own Right

- Unveiling Julianne Phillips Beyond The Spotlight Of The Wife Of Bruce

- ATM Withdrawals: Using an ATM to withdraw cash from an Airtel Payments Bank account typically incurs a higher charge compared to other methods. This charge covers the costs associated with maintaining and operating ATM infrastructure, including network connectivity, security measures, and cash management.

- Over-the-Counter Withdrawals: Withdrawing money over-the-counter at an Airtel retail store or authorized agent location generally attracts a lower charge than ATM withdrawals. This method involves manual processing and verification by Airtel staff, resulting in lower operational costs.

- UPI Transactions: UPI-based withdrawals through the Airtel Thanks app or other UPI platforms often come with minimal or no charges. UPI transactions leverage the interbank payment system, reducing the need for intermediaries and associated costs.

By understanding the varying charges associated with different withdrawal methods, Airtel Payments Bank customers can make informed decisions to minimize transaction costs and maximize their account balance. Airtel's transparent policies and easily accessible information empower customers to choose the most suitable withdrawal method based on their specific needs and financial situation.

Charge Percentage

The "Charge Percentage" is a crucial component of "Airtel Withdraw Charges" as it determines the amount of fee levied on every withdrawal transaction. Understanding this concept is essential for effectively managing finances and optimizing the use of Airtel Payments Bank services.

The charge percentage varies based on the withdrawal method chosen, as discussed earlier. ATM withdrawals typically incur a higher charge percentage compared to over-the-counter or UPI transactions. This variation reflects the differing costs associated with each method, such as network maintenance, cash handling, and operational expenses.

For instance, if the charge percentage for ATM withdrawals is 5% and a customer withdraws Rs. 1000, a charge of Rs. 50 will be deducted from their Airtel Payments Bank account. Similarly, if the charge percentage for UPI transactions is 0%, withdrawing Rs. 1000 through UPI will not incur any charges.

Comprehending the charge percentage empowers customers to make informed decisions regarding their withdrawal methods. By selecting the option with the lowest charge percentage, they can minimize transaction costs and maximize their account balance. Airtel's transparent policies and easily accessible information allow customers to plan their withdrawals strategically and avoid unnecessary charges.

Minimum Charge

The "Minimum Charge" is a significant aspect of "Airtel Withdraw Charges" as it establishes a lower limit for transaction fees, irrespective of the withdrawal amount. Understanding this concept is crucial for effectively managing finances and optimizing the use of Airtel Payments Bank services.

- Fixed Cost Component: The minimum charge represents a fixed cost incurred by Airtel for processing every withdrawal transaction. This cost covers expenses such as infrastructure maintenance, operational overheads, and regulatory compliance, ensuring the smooth functioning of Airtel Payments Bank services.

- Small Withdrawal Impact: The minimum charge can have a significant impact on small withdrawal amounts. For instance, if the minimum charge is Rs. 10 and a customer withdraws Rs. 50, the charge would account for a substantial 20% of the withdrawal amount. This highlights the importance of considering the minimum charge when planning withdrawals, especially for smaller amounts.

- Optimal Withdrawal Strategy: To minimize the impact of the minimum charge, customers can consider withdrawing larger amounts less frequently. By consolidating withdrawals, they can reduce the number of transactions and, consequently, the total charges incurred.

- Comparison with Other Charges: The minimum charge should be considered in conjunction with the "Charge Percentage" discussed earlier. While the charge percentage determines the fee based on the withdrawal amount, the minimum charge sets a lower bound for the transaction cost. Understanding both these charges together provides a comprehensive view of Airtel Withdraw Charges.

Comprehending the "Minimum Charge" empowers customers to make informed decisions regarding their withdrawal patterns. By considering the fixed cost component, the impact on small withdrawals, and the optimal withdrawal strategy, customers can minimize transaction costs and maximize their account balance. Airtel's transparent policies and easily accessible information allow customers to plan their withdrawals strategically and avoid unnecessary charges.

Transaction Limit

Transaction limits play a crucial role in managing "airtel withdraw charges" by establishing boundaries for the number and value of transactions that can be performed within a specific timeframe. These limits are implemented to maintain financial stability, prevent fraud, and ensure the smooth functioning of Airtel's services.

- Withdrawal Limit: Daily and monthly withdrawal limits restrict the total amount of money that can be withdrawn from an Airtel Payments Bank account within those timeframes. These limits help prevent excessive withdrawals and protect against unauthorized access to funds.

- Transaction Count Limit: Limits on the number of transactions per day or month help prevent excessive usage of Airtel's services and maintain the integrity of the payment infrastructure. This limits the potential for fraudulent activities and ensures fair access to services for all customers.

- Cumulative Charges: Transaction limits also impact the accumulation of "airtel withdraw charges." By limiting the number and value of transactions, customers can better control the overall charges incurred and avoid exceeding their financial budget.

- Compliance with Regulations: Transaction limits may also be imposed to comply with regulatory requirements and industry best practices. These limits help prevent money laundering, terrorism financing, and other illegal activities.

Understanding transaction limits is essential for customers to effectively manage their Airtel Payments Bank accounts and optimize their financial transactions. Airtel's transparent policies and easily accessible information empower customers to plan their withdrawals strategically, avoid unnecessary charges, and maintain control over their finances.

Convenience Fee

The "Convenience Fee" is an additional charge that may be levied on certain withdrawal methods offered by Airtel Payments Bank. Understanding the connection between the convenience fee and "airtel withdraw charges" is crucial for customers to make informed decisions and manage their finances effectively.

- Transaction Convenience: The convenience fee compensates Airtel for providing convenient and accessible withdrawal methods beyond traditional banking channels. These methods, such as over-the-counter withdrawals at retail stores or cash-out services at agent locations, offer customers the flexibility to withdraw funds without visiting a bank branch.

- Operational Costs: The convenience fee helps cover the operational costs associated with maintaining and expanding these withdrawal channels. Airtel incurs expenses such as staff training, infrastructure upkeep, and security measures to ensure the smooth functioning of these services.

- Market Dynamics: The convenience fee may also reflect market dynamics and competitive pressures. Airtel considers industry practices, customer demand, and the overall cost of providing convenient withdrawal services when determining the convenience fee.

- Customer Choice: The convenience fee provides customers with a choice between traditional banking channels and more convenient withdrawal methods. Customers can weigh the convenience factor against the additional cost and select the option that best meets their needs and preferences.

Comprehending the connection between the convenience fee and "airtel withdraw charges" empowers customers to make informed decisions regarding their withdrawal methods. By considering the value of convenience, operational costs, market dynamics, and customer choice, customers can optimize their financial transactions and manage their Airtel Payments Bank accounts effectively.

Bank Charges

In the context of "airtel withdraw charges," bank charges refer to additional fees that may be imposed by the bank that owns or operates the ATM or withdrawal location used for cash withdrawals. Understanding this connection is essential for customers to fully comprehend the costs associated with Airtel's withdrawal services.

- Interbank Agreements: Airtel Payments Bank has agreements with various banks to enable customers to withdraw cash from their Airtel Payments Bank accounts at ATMs and over-the-counter locations. These agreements may include provisions for the levying of additional charges by the partner banks.

- ATM Maintenance and Operation: Banks incur significant costs in maintaining and operating their ATM networks. These costs include hardware and software upgrades, cash management, and security measures. Bank charges help offset these expenses and ensure the continued availability of ATM services to customers.

- Location and Accessibility: The location and accessibility of ATMs and withdrawal locations can also influence bank charges. ATMs located in remote or less accessible areas may incur higher charges due to increased operational and security costs.

- Transaction Volume: The volume of transactions processed by an ATM or withdrawal location can impact bank charges. Higher transaction volumes may result in higher charges to cover the increased costs of cash handling, network connectivity, and staff.

Comprehending the implications of bank charges empowers Airtel Payments Bank customers to make informed decisions regarding their withdrawal methods. By considering the role of interbank agreements, ATM maintenance costs, location factors, and transaction volume, customers can optimize their financial transactions and minimize unnecessary charges.

Account Balance

The relationship between "Account Balance: Charges are deducted from the Airtel Payments Bank account balance" and "airtel withdraw charges" is fundamental to understanding the financial implications of withdrawal transactions. Airtel withdraw charges directly impact the account balance, as they are deducted from the available funds in the Airtel Payments Bank account.

When a customer initiates a withdrawal transaction, whether through an ATM, over-the-counter location, or UPI, the applicable charges are calculated based on factors such as the withdrawal method, amount, and any applicable fees or convenience charges. These charges are then deducted from the customer's account balance, reducing the amount of available funds.

Understanding this connection is crucial for effective financial management. By being aware that withdrawal charges are deducted from the account balance, customers can plan their withdrawals accordingly to avoid overdraft fees or insufficient balance situations. Airtel's transparent policies and easily accessible information empower customers to monitor their account balance and track withdrawal charges, enabling them to make informed decisions about their financial transactions.

Transaction Receipt

The transaction receipt plays a significant role in understanding "airtel withdraw charges" as it provides tangible evidence of the withdrawal transaction and the associated charges. This receipt serves as a valuable tool for customers to track their financial activities and verify the accuracy of charges levied on their Airtel Payments Bank account.

The receipt typically includes essential information such as the transaction date and time, withdrawal amount, applicable charges, and the remaining account balance. By reviewing the transaction receipt, customers can easily identify the charges incurred for each withdrawal, ensuring transparency and accountability in the withdrawal process.

Furthermore, the transaction receipt serves as a crucial reference document in case of any discrepancies or disputes related to withdrawal charges. Customers can use the receipt as evidence to support their claims and seek assistance from Airtel's customer support team if required. This helps maintain trust and confidence in the withdrawal process and ensures that customers' concerns are addressed promptly.

In conclusion, the transaction receipt is an integral component of "airtel withdraw charges" as it provides documented proof of the withdrawal transaction and the associated charges. It empowers customers to monitor their financial activities, verify the accuracy of charges, and resolve any discrepancies. Airtel's commitment to providing customers with transaction receipts reflects its focus on transparency, accountability, and customer satisfaction.

Transaction History

The "Transaction History" feature provided by Airtel is intricately connected to "airtel withdraw charges" as it offers customers a comprehensive record of their withdrawal transactions and the associated charges. This detailed history serves as a valuable tool for customers to monitor their financial activities and gain insights into their withdrawal patterns.

By accessing their transaction history, customers can easily identify the dates, times, amounts, and charges of each withdrawal they have made. This information is crucial for understanding the impact of withdrawal charges on their account balance and overall financial management. The transaction history empowers customers to track their expenses, identify any unusual or unauthorized transactions, and ensure that the charges levied are accurate.

Furthermore, the transaction history serves as a valuable reference document for customers to manage their finances effectively. By reviewing their withdrawal history, customers can identify patterns in their spending and optimize their withdrawal strategies to minimize charges. This understanding helps them make informed decisions about their financial habits and plan their withdrawals to avoid excessive charges.

In summary, the "Transaction History: Airtel provides a detailed transaction history for tracking withdrawals" is an essential component of "airtel withdraw charges" as it provides customers with transparency and control over their withdrawal transactions. By leveraging this feature, customers can monitor their financial activities, identify charges, and make informed decisions, ultimately leading to better financial management and peace of mind.

Customer Support

The connection between "Customer Support: Airtel offers customer support for any queries or issues related to Withdraw Charges" and "airtel withdraw charges" lies in the crucial role customer support plays in addressing customer concerns, resolving issues, and providing guidance on withdrawal charges. Airtel's commitment to customer support empowers customers to navigate withdrawal charges with clarity and confidence.

- Real-time Assistance: Customers can directly contact Airtel's customer support via phone, email, or live chat to seek immediate assistance with any queries or issues related to withdrawal charges. This real-time support helps customers resolve their concerns promptly, avoiding unnecessary delays or frustrations.

- Dispute Resolution: In case of any discrepancies or disputes regarding withdrawal charges, customers can reach out to customer support to lodge a complaint or seek clarification. Airtel's dedicated team investigates the issue thoroughly and provides a fair resolution, ensuring customer satisfaction.

- Policy Explanation: Customers may have questions about Airtel's withdrawal charges policy, including the calculation of charges, applicable limits, and exemptions. Customer support representatives are well-equipped to explain the policy in detail, helping customers understand the charges and make informed decisions.

- Feedback and Suggestions: Customer support serves as a valuable channel for customers to provide feedback and suggestions on Airtel's withdrawal charges. This feedback loop enables Airtel to continuously improve its services, optimize charges, and enhance the overall customer experience.

In conclusion, Airtel's comprehensive customer support plays a vital role in managing "airtel withdraw charges" by providing real-time assistance, resolving disputes, explaining policies, and gathering customer feedback. Airtel's commitment to customer support ensures that customers have a clear understanding of withdrawal charges and can confidently manage their finances.

FAQs

This section addresses frequently asked questions (FAQs) related to Airtel Withdraw Charges, providing concise and informative answers to common concerns and misconceptions.

Question 1: What are Airtel Withdraw Charges?Airtel Withdraw Charges are fees levied by Airtel Payments Bank for withdrawing money from its accounts. These charges vary depending on the withdrawal method used, such as ATM withdrawals, over-the-counter withdrawals, or UPI transactions.

Question 2: Why are Airtel Withdraw Charges imposed?Airtel Withdraw Charges cover the costs associated with processing withdrawal transactions and maintaining the Airtel Payments Bank infrastructure, including network connectivity, security measures, and cash management.

Question 3: How can I minimize Airtel Withdraw Charges?Customers can minimize Airtel Withdraw Charges by choosing withdrawal methods with lower charges, consolidating withdrawals to reduce transaction frequency, and being aware of any minimum charges or convenience fees.

Question 4: What is the difference between Airtel Withdraw Charges and Bank Charges?Airtel Withdraw Charges are levied by Airtel Payments Bank, while Bank Charges may be additionally imposed by the bank associated with the ATM or withdrawal location.

Question 5: How can I track my Airtel Withdraw Charges?Customers can track their Airtel Withdraw Charges through transaction receipts and detailed transaction history provided by Airtel Payments Bank, enabling them to monitor their financial activities and identify any discrepancies.

Question 6: What should I do if I have a dispute regarding Airtel Withdraw Charges?In case of any disputes or concerns related to Airtel Withdraw Charges, customers can contact Airtel's customer support for assistance in resolving the issue and providing clarification on the charges.

Understanding Airtel Withdraw Charges is crucial for effective financial management. By being aware of these charges and the factors that influence them, customers can make informed decisions about their withdrawal methods and minimize unnecessary expenses.

Transition to the next article section...

Tips to Optimize Airtel Withdraw Charges

Understanding Airtel Withdraw Charges is the first step towards effective financial management. Here are some practical tips to help you optimize these charges and minimize unnecessary expenses:

Tip 1: Choose Withdrawal Methods WiselyDifferent withdrawal methods incur varying charges. ATM withdrawals generally have higher charges compared to over-the-counter withdrawals or UPI transactions. Consider the charges associated with each method before making a withdrawal.Tip 2: Consolidate Withdrawals

Making multiple small withdrawals can accumulate charges. Instead, plan your withdrawals and consolidate them into larger, less frequent transactions. This reduces the number of transactions and, consequently, the total charges incurred.Tip 3: Be Aware of Minimum Charges

Some withdrawal methods have minimum charges, regardless of the withdrawal amount. Be aware of these charges to avoid unnecessary expenses, especially when withdrawing small amounts.Tip 4: Use Airtel ATMs or Partner Banks

Withdrawing cash from Airtel ATMs or ATMs of partner banks often attracts lower charges compared to using ATMs of other banks. Check with Airtel for a list of partner banks.Tip 5: Utilize UPI Transactions

UPI transactions through the Airtel Thanks app or other UPI platforms typically have minimal or no charges. Consider using UPI for convenient and cost-effective withdrawals.Tip 6: Track Your Transactions

Keep track of your withdrawal transactions through Airtel's transaction history feature. Regularly review your charges to identify any discrepancies or areas for optimization.Tip 7: Contact Customer Support

If you have any questions or concerns regarding Airtel Withdraw Charges, don't hesitate to contact Airtel's customer support. They can provide clarification, assist with dispute resolution, and offer guidance on optimizing your charges.

By following these tips, you can effectively manage your Airtel Withdraw Charges, minimize expenses, and make the most of your Airtel Payments Bank account.

Conclusion...

Conclusion

In conclusion, Airtel Withdraw Charges are an essential aspect of managing finances through Airtel Payments Bank. Understanding these charges empowers customers to make informed decisions about their withdrawal methods and minimize unnecessary expenses. By choosing withdrawal methods wisely, consolidating withdrawals, being aware of minimum charges, and utilizing cost-effective options like Airtel ATMs and UPI transactions, customers can optimize their Airtel Withdraw Charges and maximize their account balance.

Airtel's commitment to transparency and customer support ensures that customers have access to clear information about withdrawal charges and can easily resolve any queries or disputes. By following the tips outlined in this article, customers can effectively manage their Airtel Withdraw Charges and enjoy a seamless banking experience.

- Unveiling Todd Haleys Net Worth Uncovering Secrets And Strategies

- Unlocking The Secrets Is Scottie Scheffler Married

- Uncover The Secrets Of Skip The Game Odessa A Journey Of Discovery

- Unveil The Hidden Uncover The Untold Truths That Will Reshape Your World

- Uncover The Secrets And Symbolism Of The Welcome To Death Row Meme

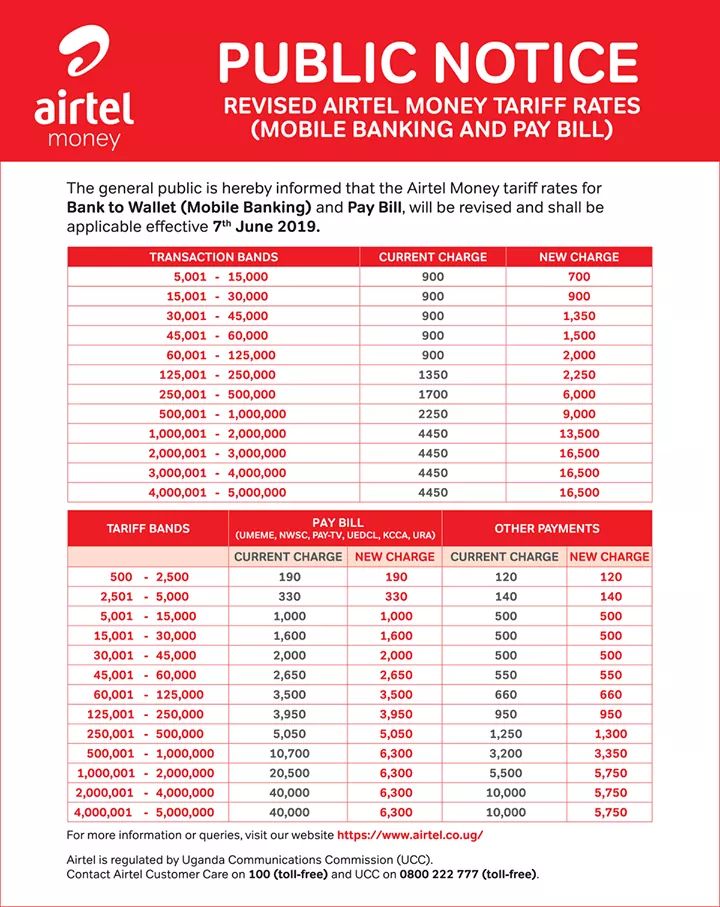

In Uganda, Airtel money charges in 2019, including mobile money to bank

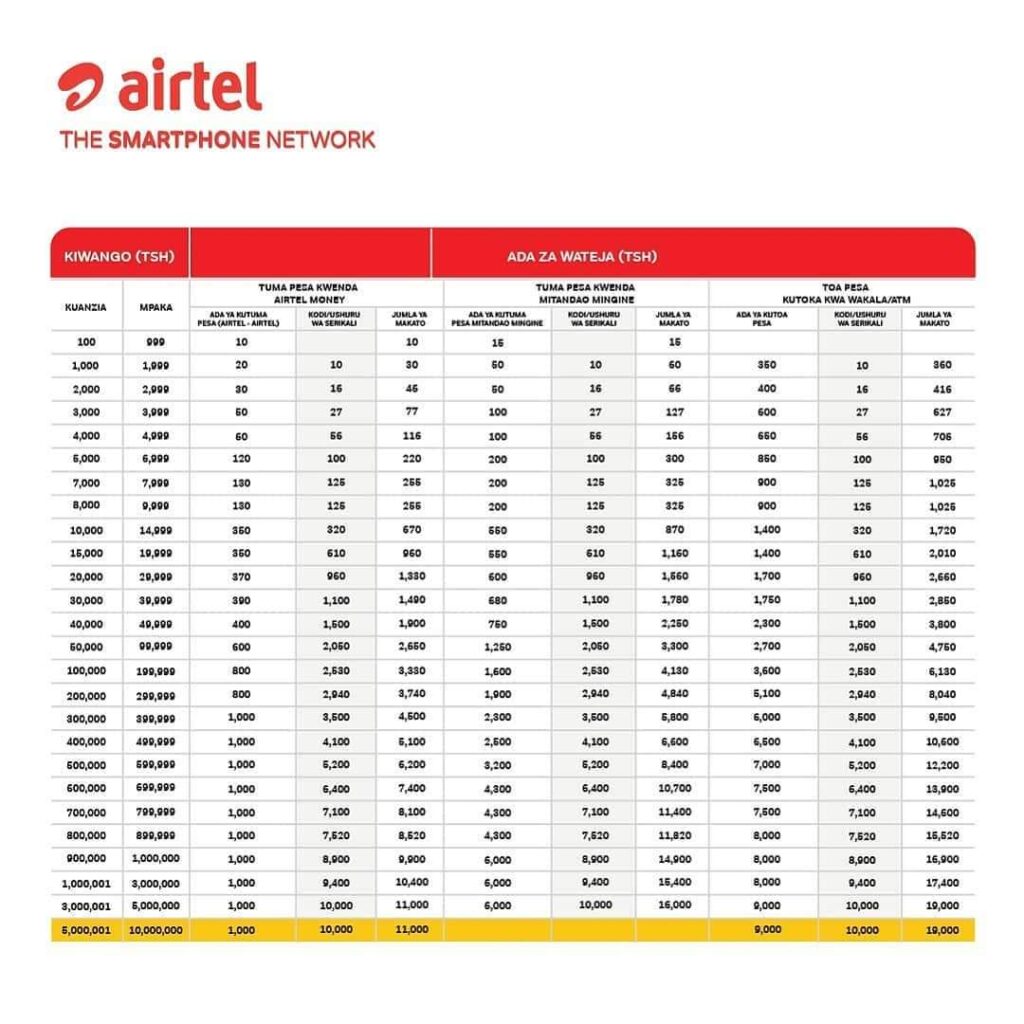

Airtel Money Charges 2021/2022 (Makato Mpya Airtel Money)