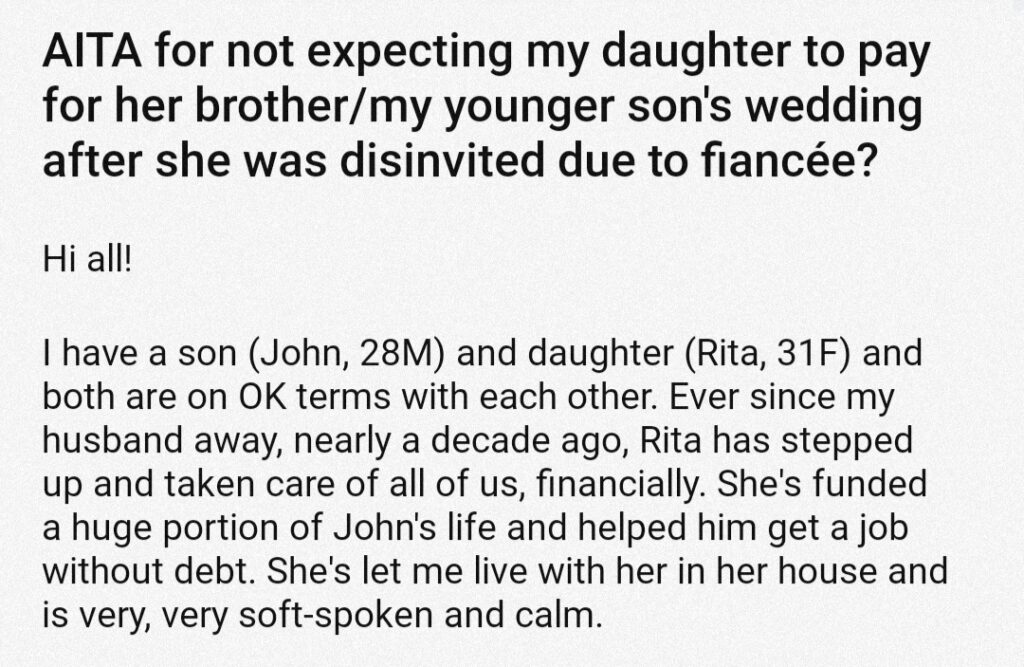

Uncover Surprising Truths: AITA For Not Expecting My Daughter To Pay?

The phrase "AITA for not expecting my daughter to pay" refers to a situation where a parent is questioning whether they are being unreasonable (hence "AITA" - "Am I the A-hole") for not expecting their daughter to contribute financially to the household.

In many families, it is customary for children to contribute to the household expenses once they reach a certain age and start earning an income. However, there may be circumstances where a parent chooses not to expect this from their child, such as if the child is still in school or has other financial obligations.

Ultimately, the decision of whether or not to expect a child to contribute financially to the household is a personal one that each family must make based on their own circumstances.

- Unveiling The Truth Exploring Ray Stevensons Cause Of Death

- Unlock Your Potential With Dr Sams 7second Morning Ritual

- Wi Wi Wi Cat

- Jenna Lyons Height Surprising Truths And Fashion Revelations

- Unveiling The Truth Alicia Menendezs Marital Status Revealed

If you are considering asking your child to contribute financially to the household, it is important to have a clear and open conversation with them about your expectations. It is also important to be understanding and supportive if your child is not able to meet your expectations.

AITA for not expecting my daughter to pay?

When it comes to the question of whether or not parents should expect their children to contribute financially to the household, there is no easy answer. There are many factors to consider, such as the child's age, income, and financial obligations. Ultimately, the decision of whether or not to expect a child to contribute financially is a personal one that each family must make based on their own circumstances.

- Financial need: If the family is struggling financially, it may be necessary for the child to contribute in order to help make ends meet.

- Age and maturity: If the child is old enough and mature enough to handle the responsibility, they may be expected to contribute.

- Cultural expectations: In some cultures, it is customary for children to contribute financially to the household, regardless of their age or income.

- Child's financial obligations: If the child has other financial obligations, such as student loans or rent, they may not be able to afford to contribute to the household.

- Parent's financial situation: If the parents are financially secure, they may not need the child's financial contribution.

- Family values: Some families believe that it is important for children to contribute financially to the household, while others believe that it is more important for children to focus on their education and personal development.

- Child's relationship with parents: If the child has a good relationship with their parents, they may be more willing to contribute financially.

- Parents' expectations: Parents should be clear about their expectations for their child's financial contribution.

- Communication: It is important for parents and children to communicate openly and honestly about financial expectations.

Ultimately, the decision of whether or not to expect a child to contribute financially to the household is a complex one. There are many factors to consider, and there is no easy answer. However, by considering the factors discussed above, parents can make an informed decision that is right for their family.

- Uncover The Thrilling World Of Cambodian Sports With Khmer Sport News

- Noelle Leyvas Onlyfans Leak Uncovered Secrets And Revelations

- Unveiling The Cinematic Treasures Of Lone Pine A Western Odyssey With James Marsden

- Unveiling Natasha Yis Net Worth Unlocking Financial Insights

- Uncovering The Truth Jesse Goins Death And The Fight For Justice

Financial need

In the context of the question "AITA for not expecting my daughter to pay," financial need is a key factor to consider. If a family is struggling financially, it may be necessary for the child to contribute in order to help make ends meet. This is especially true if the child is an adult and has a job.

- Impact on child: If a child is expected to contribute financially to the household, it can have a significant impact on their life. They may have less money to spend on their own needs, and they may have to work more hours or take on a second job.

- Impact on family: If a child is not expected to contribute financially to the household, it can put a strain on the family budget. This can lead to financial problems, and it can also create resentment between family members.

- Impact on parent-child relationship: If a parent expects their child to contribute financially to the household, it can damage the parent-child relationship. This is especially true if the child feels that they are being taken advantage of.

- Importance of communication: It is important for parents and children to communicate openly and honestly about financial expectations. This will help to avoid misunderstandings and resentment.

Ultimately, the decision of whether or not to expect a child to contribute financially to the household is a complex one. There are many factors to consider, and there is no easy answer. However, by considering the financial need of the family, the impact on the child, and the importance of communication, parents can make an informed decision that is right for their family.

Age and maturity

The age and maturity of a child is a key factor to consider when deciding whether or not to expect them to contribute financially to the household. In general, older children who are more mature are more likely to be able to handle the responsibility of contributing financially.

- Responsibility: Contributing financially to the household is a responsibility that requires maturity and understanding. Younger children may not be able to fully understand the importance of contributing, and they may not be able to handle the responsibility of managing their own finances.

- Financial literacy: Children who are financially literate are more likely to be able to manage their own finances and contribute to the household in a meaningful way. They should have a basic understanding of budgeting, saving, and investing.

- Work ethic: Children who have a good work ethic are more likely to be willing to contribute to the household. They should be willing to work hard and earn money, and they should be responsible with their earnings.

- Sense of community: Children who have a strong sense of community are more likely to want to contribute to the household. They should feel like they are part of the family and that they have a responsibility to help out.

Ultimately, the decision of whether or not to expect a child to contribute financially to the household is a complex one. There are many factors to consider, such as the child's age, maturity, financial literacy, work ethic, and sense of community. Parents should carefully consider all of these factors before making a decision.

Cultural expectations

In many cultures around the world, it is customary for children to contribute financially to the household, regardless of their age or income. This is often seen as a way for children to show their gratitude for their parents' care and support, and to learn the value of hard work and responsibility. In some cultures, it is also seen as a way for children to prepare for their future financial independence.

- Role of cultural norms: In cultures where it is customary for children to contribute financially to the household, there is often a strong sense of family obligation and responsibility. Children are expected to help out around the house and to contribute to the family's income in whatever way they can.

- Examples from real life: In many Asian cultures, it is common for children to give their parents a portion of their earnings. This is seen as a way of showing respect and gratitude to one's parents.

- Implications for "AITA for not expecting my daughter to pay": When considering whether or not to expect your daughter to contribute financially to the household, it is important to be aware of the cultural expectations that may be at play. If you are from a culture where it is customary for children to contribute financially, your daughter may be expecting to do so, even if you do not explicitly ask her to.

Ultimately, the decision of whether or not to expect your daughter to contribute financially to the household is a personal one. However, it is important to be aware of the cultural expectations that may be at play and to communicate your expectations clearly to your daughter.

Child's financial obligations

When considering whether or not to expect your daughter to contribute financially to the household, it is important to take into account her other financial obligations. If she has student loans or rent to pay, she may not have the financial means to contribute to the household. This is especially true if she is just starting out in her career and has a low income.

- Impact on the child: Expecting a child to contribute financially to the household when they have other financial obligations can put a strain on their finances. They may have to work more hours or take on a second job, which can leave them with less time for their studies or other activities. They may also have to cut back on their expenses, which can impact their quality of life.

- Impact on the family: If a child is unable to contribute financially to the household, it can put a strain on the family budget. This can lead to financial problems, and it can also create resentment between family members.

- Importance of communication: It is important for parents and children to communicate openly and honestly about financial expectations. This will help to avoid misunderstandings and resentment.

Ultimately, the decision of whether or not to expect your daughter to contribute financially to the household is a personal one. However, it is important to be aware of her other financial obligations and to communicate your expectations clearly.

Parent's financial situation

When considering whether or not to expect your daughter to contribute financially to the household, it is important to take into account your own financial situation. If you are financially secure and do not need your daughter's financial contribution to make ends meet, you may choose not to expect her to contribute.

- Role of financial security: When parents are financially secure, they may feel less pressure to expect their children to contribute financially to the household. They may be able to afford to cover all of the household expenses on their own, and they may not want to put any additional financial burden on their children.

- Examples from real life: In some families, parents who are financially secure may choose to pay for their children's college education or to help them buy their first home. This is a way of showing their love and support for their children, and it can help the children to achieve their financial goals.

- Implications for "AITA for not expecting my daughter to pay": If you are financially secure and do not need your daughter's financial contribution, you may not be the a-hole for not expecting her to pay. However, it is important to communicate your expectations to her clearly and to be prepared to answer her questions about why you are not expecting her to contribute.

Ultimately, the decision of whether or not to expect your daughter to contribute financially to the household is a personal one. There are many factors to consider, such as your own financial situation, your daughter's financial situation, and your family's values. It is important to weigh all of these factors carefully before making a decision.

Family values

The question of whether or not to expect children to contribute financially to the household is a complex one, and there is no easy answer. There are many factors to consider, such as the family's financial situation, the child's age and maturity, and the family's values.

- Role of family values: Family values play a significant role in shaping expectations around children's financial contributions. In families where there is a strong emphasis on financial responsibility, children may be expected to contribute to the household from a young age. In other families, there may be a greater focus on education and personal development, and children may not be expected to contribute financially until they are older or have finished their education.

- Examples from real life: In some families, children are expected to get a job and start contributing to the household as soon as they turn 16. In other families, children are not expected to contribute financially until they are out of college and have a full-time job.

- Implications for "AITA for not expecting my daughter to pay": The question of whether or not to expect your daughter to contribute financially to the household is a personal one, and there is no right or wrong answer. However, it is important to be aware of the family values that may be at play and to communicate your expectations clearly to your daughter.

Ultimately, the decision of whether or not to expect your daughter to contribute financially to the household is a matter of personal judgment. There is no right or wrong answer, and the best decision will vary depending on the specific circumstances of your family.

Child's relationship with parents

The relationship between a child and their parents is a complex one, and it can have a significant impact on the child's willingness to contribute financially to the household. Children who have a good relationship with their parents are more likely to feel loved and supported, and they may be more willing to help out around the house and contribute to the family's finances.

There are a number of reasons why children who have a good relationship with their parents may be more willing to contribute financially. First, they may feel a sense of obligation to their parents. They may feel that they owe their parents for all that they have done for them, and they may want to repay them by contributing financially.

Second, children who have a good relationship with their parents may be more likely to internalize the family's values. If the family values financial responsibility, the child may be more likely to adopt those values and to want to contribute to the household.

Finally, children who have a good relationship with their parents may be more likely to feel comfortable talking to them about money. They may be more willing to discuss their financial situation and to ask for help if they need it.

Of course, there are also children who have a good relationship with their parents but who are not willing to contribute financially to the household. This may be due to a number of factors, such as the child's age, maturity, or financial situation.

However, in general, children who have a good relationship with their parents are more likely to be willing to contribute financially to the household. This is something that parents should keep in mind when they are considering whether or not to expect their children to contribute.

Parents' expectations

When it comes to the question of "aita for not expecting my daughter to pay," the issue of parents' expectations is a key factor to consider. Parents should be clear about their expectations for their child's financial contribution, as this can help to avoid misunderstandings and resentment.

Communication

Open and honest communication between parents and children about financial expectations is crucial to avoid misunderstandings and resentment. When parents fail to communicate their expectations clearly, it can lead to feelings of guilt or obligation on the child's part, and can also damage the parent-child relationship.

For example, if a parent expects their child to contribute financially to the household but does not communicate this expectation clearly, the child may feel guilty or obligated to contribute even if they are not financially able to do so. This can lead to resentment and conflict between the parent and child.

On the other hand, when parents communicate their financial expectations clearly and honestly, it allows the child to make informed decisions about how they want to contribute to the household. This can help to avoid misunderstandings and resentment, and can also strengthen the parent-child relationship.

In the context of the question "aita for not expecting my daughter to pay," communication is key. If a parent does not expect their child to contribute financially to the household, it is important to communicate this expectation clearly to the child. This will help to avoid any misunderstandings or resentment down the road.

FAQs on "AITA for not expecting my daughter to pay"

This section addresses common concerns or misconceptions surrounding the topic of whether or not it is reasonable for parents to expect their children to contribute financially to the household, particularly in the context of a daughter.

Question 1: Is it wrong for parents to expect their children to contribute financially to the household?

Answer: The decision of whether or not to expect children to contribute financially to the household is a personal one that each family must make based on their own circumstances. There is no right or wrong answer, and the best decision will vary depending on factors such as the family's financial situation, the child's age and maturity, and the family's values.

Question 2: What are some factors to consider when deciding whether or not to expect children to contribute financially?

Answer: Some factors to consider include the child's age and maturity, the family's financial situation, the child's other financial obligations, the family's cultural expectations, the child's relationship with their parents, the parents' expectations, and the importance of communication.

Question 3: What are the benefits of expecting children to contribute financially to the household?

Answer: Some benefits include teaching children the value of money and responsibility, helping to prepare them for financial independence, and reducing the financial burden on parents.

Question 4: What are the drawbacks of expecting children to contribute financially to the household?

Answer: Some drawbacks include putting a strain on the child's finances, creating resentment between family members, and damaging the parent-child relationship.

Question 5: What is the best way to communicate with children about financial expectations?

Answer: It is important to communicate openly and honestly with children about financial expectations. This will help to avoid misunderstandings and resentment. Parents should be clear about their expectations and be prepared to answer their child's questions.

Question 6: What should parents do if their child is not able to contribute financially to the household?

Answer: If a child is not able to contribute financially to the household, parents should be understanding and supportive. They can work with their child to develop a plan to help them become financially independent in the future.

Summary of key takeaways or final thought:

The decision of whether or not to expect children to contribute financially to the household is a complex one. There are many factors to consider, and there is no easy answer. However, by considering the factors discussed above, parents can make an informed decision that is right for their family.

It is important to remember that the parent-child relationship is a two-way street. Parents should be supportive of their children, and children should be respectful of their parents. Communication is key to a healthy parent-child relationship, and it is important to talk openly and honestly about financial expectations.

Transition to the next article section:

The following section will explore the topic of "adult children living at home" in more detail.

Tips for Navigating the Issue of Children Contributing Financially to the Household

Deciding whether or not to expect children to contribute financially to the household can be a complex and challenging issue. By following these tips, parents can approach this topic in a thoughtful and productive manner:

Communicate openly and honestly with your child about financial expectations.

Discuss your financial situation and explain your reasons for expecting (or not expecting) your child to contribute. Be clear about your expectations and be prepared to answer your child's questions.

Consider your child's age, maturity, and financial situation.

Younger children or those with limited financial means may not be able to contribute as much as older children or those who are financially independent.

Be flexible and willing to adjust your expectations over time.

As your child's circumstances change, you may need to adjust your expectations for their financial contribution.

Avoid using financial expectations as a way to control or punish your child.

Expecting your child to contribute financially should be about teaching them responsibility and preparing them for financial independence, not about controlling their behavior.

Be supportive and understanding if your child is not able to contribute financially.

There may be times when your child is not able to contribute financially due to circumstances beyond their control. Be supportive and understanding, and work with your child to develop a plan to help them become financially independent in the future.

Seek professional help if you are struggling to communicate with your child about financial expectations.

A family therapist or financial counselor can help you to communicate your expectations in a clear and constructive way.

Conclusion:

Navigating the issue of children contributing financially to the household can be a challenging but important task. By following these tips, parents can approach this topic in a thoughtful and productive manner, and can help to foster a healthy and responsible relationship with their children.

Conclusion

The question of whether or not to expect children to contribute financially to the household is a complex one, with no easy answers. There are many factors to consider, such as the family's financial situation, the child's age and maturity, and the family's values. Ultimately, the decision of whether or not to expect a child to contribute financially is a personal one that each family must make based on their own circumstances.

However, it is important to remember that the parent-child relationship is a two-way street. Parents should be supportive of their children, and children should be respectful of their parents. Communication is key to a healthy parent-child relationship, and it is important to talk openly and honestly about financial expectations.

- Unlock Exclusive Snoop Dogg Updates Uncover Contact Secrets

- Dark Hair With Highlights

- Uncover The Secrets Behind El Pack De Yeferson Cossio

- Uncover The Legacy Of Michael Landon Through Sean Matthew Landon

- Uncover The Secrets Of Skip The Game Odessa A Journey Of Discovery

AITA For Not Allowing My Daughter To Go To A Sleepover?

AITA For Not Expecting My Daughter To Pay Her Brother My Younger Son’s